Introduction

The Microbial Inoculants Market refers to the global industry focused on the production and commercialization of beneficial microorganisms used to enhance soil fertility, crop productivity, and plant health. These inoculants contain living microbes such as bacteria, fungi, algae, or protozoa that interact with plants and soil ecosystems to improve nutrient availability and biological activity.

The global importance of microbial inoculants continues to rise due to increasing pressure on agricultural systems to produce higher yields while reducing environmental impact. Modern farming practices face challenges related to soil degradation, chemical overuse, and climate variability. Microbial inoculants offer a biological solution aligned with sustainable agriculture and integrated nutrient management.

As of 2024, the microbial inoculants market is estimated to be valued at approximately USD 5.2 billion, reflecting strong adoption across developed and emerging agricultural economies. The market holds high relevance in row crops, horticulture, pasture management, and specialty farming segments. Growing awareness of soil health and regulatory support for biological inputs reinforce its strategic role in global agriculture.

The Evolution of the Microbial Inoculants Market

The development of microbial inoculants traces back to early agricultural science when nitrogen-fixing bacteria were identified for legume crops in the late 19th century. Initial commercial products focused mainly on Rhizobium strains for soybean and pulse cultivation.

During the mid-20th century, advancements in microbiology expanded the understanding of soil-plant-microbe interactions. Research institutions and agricultural universities played a key role in isolating beneficial microbial strains with targeted agronomic functions. Early adoption remained limited due to storage instability and inconsistent field performance.

The late 1990s and early 2000s marked a turning point with improved fermentation technologies, carrier materials, and formulation techniques. Liquid inoculants and shelf-stable products gained market acceptance. Molecular biology and genomics enabled precise strain selection and functional validation.

Shifts in demand accelerated as farmers faced rising fertilizer costs and stricter environmental standards. Technology adoption increased across precision agriculture platforms, enabling site-specific microbial applications. The market transitioned from single-strain products to multi-strain consortia designed for broader soil and crop compatibility.

Market Trends

Consumer trends in agriculture show growing preference for sustainable and residue-free food production. Farmers increasingly seek biological alternatives that support long-term soil productivity while maintaining yield stability. Organic farming expansion contributes significantly to inoculant demand.

Technology adoption plays a central role in market growth. Innovations in microbial encapsulation, controlled-release formulations, and seed-coating technologies improve product efficacy. Advances in bioinformatics support the discovery of high-performance microbial strains adapted to diverse climates and soil types.

Digital agriculture tools support microbial inoculant usage by integrating soil diagnostics, crop monitoring, and application timing. This integration enhances adoption among large-scale commercial farms.

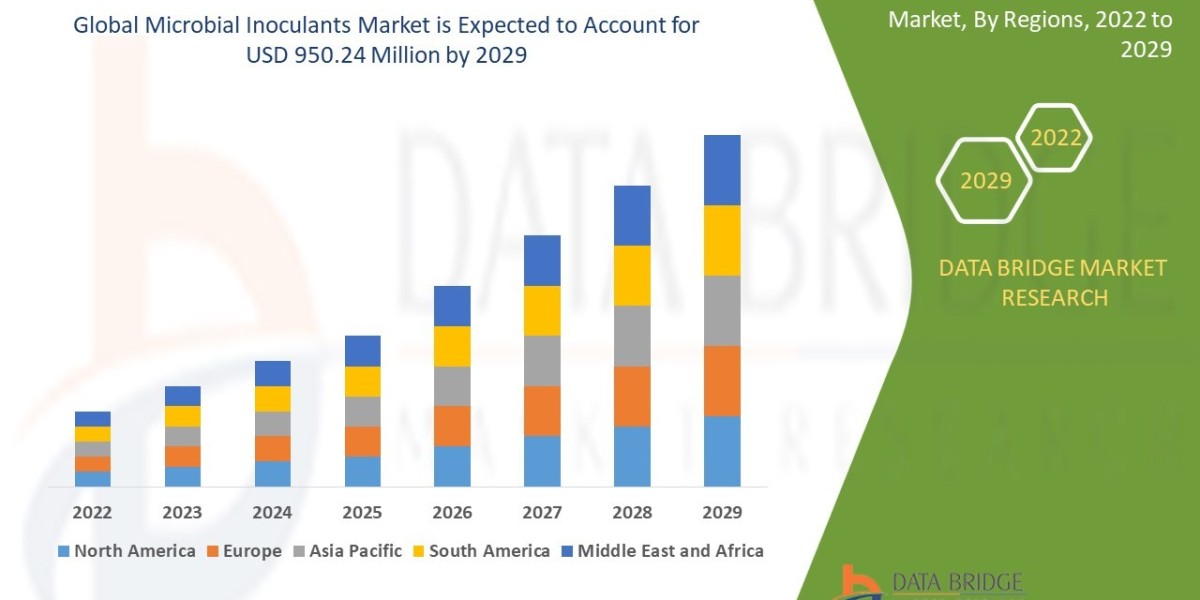

Regional adoption patterns vary. North America and Europe lead in research-driven product development and regulatory frameworks supporting biologicals. Asia-Pacific shows rapid growth driven by large agricultural land areas, government-led soil health initiatives, and increasing awareness among smallholder farmers. Latin America demonstrates strong adoption in soybean, maize, and sugarcane cultivation. The Middle East and Africa show gradual uptake linked to soil restoration and arid land farming projects.

Challenges

The microbial inoculants industry faces several challenges related to regulatory compliance, product standardization, and performance variability. Regulatory frameworks differ across regions, creating complexity in product registration and market entry.

Economic challenges include price sensitivity among small-scale farmers and competition from conventional fertilizers with established distribution networks. Limited access to cold-chain logistics affects product stability in developing regions.

Supply chain challenges arise from the need for controlled manufacturing environments and specialized storage conditions. Variability in raw material quality influences microbial viability and consistency.

Key barriers to growth include limited farmer awareness, lack of technical training, and inconsistent field results under varying climatic conditions. Risks include microbial contamination, reduced shelf life, and skepticism regarding biological product reliability compared to chemical inputs.

Market Scope

Segmentation by Type

Bacterial inoculants

Fungal inoculants

Algal-based inoculants

Composite microbial consortia

Bacterial inoculants dominate the market due to their proven nitrogen fixation and phosphate solubilization capabilities.

Segmentation by Application

Seed treatment

Soil treatment

Foliar application

Seed treatment remains the leading application method due to ease of use and early-stage crop benefits.

Segmentation by Crop Type

Cereals and grains

Oilseeds and pulses

Fruits and vegetables

Turf and ornamentals

Oilseeds and pulses account for a significant share due to widespread legume cultivation.

Regional Analysis

North America

Strong R&D infrastructure and adoption of sustainable farming practices drive market maturity.

Europe

Stringent environmental regulations promote biological input adoption across commercial agriculture.

Asia-Pacific

Rapid growth due to expanding food demand, soil fertility concerns, and supportive government policies.

Latin America

High usage in large-scale crop farming with growing emphasis on yield optimization.

Middle East & Africa

Emerging market driven by soil rehabilitation projects and climate-resilient agriculture initiatives.

End-User Industries

Commercial agriculture

Organic farming

Greenhouse cultivation

Research and academic institutions

Market Size and Factors Driving Growth

The global microbial inoculants market reached an estimated value of USD 5.2 billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 11.8% from 2025 to 2035. By 2035, the market value is expected to exceed USD 16.5 billion.

Growth drivers include technological advancements in microbial strain development and formulation science. Rising global population increases food demand, driving the need for yield-enhancing inputs. Sustainability goals encourage reduced chemical fertilizer usage and improved soil health management.

Government policies supporting bio-based agricultural inputs and carbon footprint reduction further accelerate market adoption. Financial incentives, subsidies, and awareness programs support farmer transition toward biological solutions.

Emerging regions present strong opportunities due to expanding agricultural activity and increasing investment in sustainable farming infrastructure. Local production of microbial inoculants in developing economies reduces cost barriers and improves accessibility.

Conclusion

The microbial inoculants market demonstrates strong growth potential supported by sustainability-driven agricultural transformation. Rising demand for eco-friendly inputs positions microbial solutions as a critical component of modern farming systems.

Innovation remains central to market success, with advancements in microbial discovery, formulation stability, and digital integration shaping future competitiveness. Sustainability goals reinforce the importance of soil health and biological nutrient management.

Future opportunities exist for stakeholders across product development, regional expansion, and farmer education initiatives. Strategic partnerships, localized production, and continuous research investment will define long-term market leadership.

Frequently Asked Questions (FAQ)

What are microbial inoculants used for?

Microbial inoculants are used to improve soil fertility, enhance nutrient availability, promote plant growth, and support sustainable agricultural practices.

Which crops benefit most from microbial inoculants?

Legumes, cereals, oilseeds, fruits, and vegetables benefit significantly due to improved nutrient uptake and root development.

Are microbial inoculants safe for the environment?

Yes, microbial inoculants are environmentally safe and reduce reliance on chemical fertilizers, supporting soil and ecosystem health.

What factors drive microbial inoculant adoption?

Key factors include sustainability goals, rising fertilizer costs, regulatory support for biological products, and improved product performance.

Which region shows the fastest growth?

Asia-Pacific shows the fastest growth due to large agricultural land areas, food demand, and government-supported soil health initiatives.