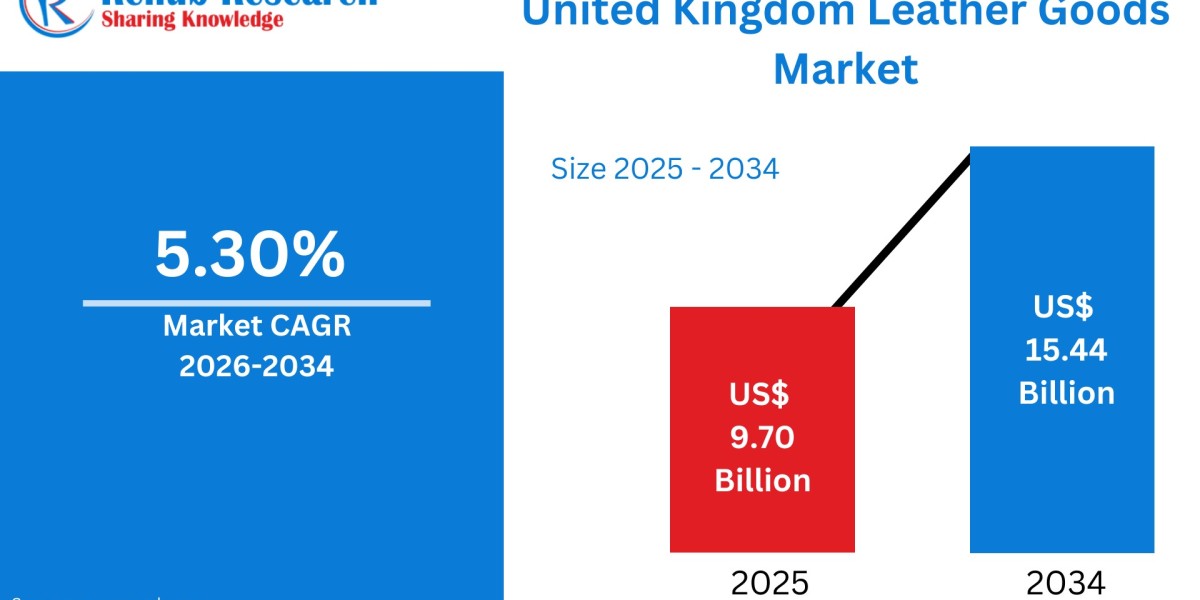

United Kingdom Leather Goods Market Size and Forecast 2026–2034

According to Renub Research United Kingdom leather goods market is projected to record steady and resilient growth over the forecast period, supported by strong consumer demand for premium fashion accessories, footwear, and travel-related products. The market is estimated to expand from US$ 9.70 billion in 2025 to US$ 15.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.30% between 2026 and 2034.

This growth reflects the UK’s deep-rooted fashion culture, the continued dominance of luxury and heritage brands, rising disposable income, and a shift toward premium and sustainable products. In parallel, the rapid expansion of online retail and direct-to-consumer channels is transforming how leather goods are marketed, sold, and consumed across the country.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=united-kingdom-leather-goods-market-p.php

United Kingdom Leather Goods Market Outlook

Leather goods refer to products made primarily from tanned animal hide, valued for durability, flexibility, aesthetic appeal, and longevity. Common leather goods include handbags, wallets, belts, footwear, jackets, luggage, travel accessories, watch straps, and upholstery items. Leather’s natural texture and ability to develop a patina over time enhance its appeal as a premium material. Manufacturing processes typically involve tanning, cutting, stitching, and finishing, carried out either through artisanal craftsmanship or large-scale industrial production.

In the United Kingdom, leather goods enjoy widespread popularity due to the nation’s strong fashion heritage, luxury retail culture, and appreciation for craftsmanship. British consumers associate leather products with sophistication, durability, and social status, making them a preferred choice for both personal use and gifting. Demand is further supported by tourism, lifestyle spending, and professional use. At the same time, the market is evolving as ethical sourcing, sustainable tanning methods, and vegan-inspired alternatives gain traction, reshaping consumer expectations while maintaining strong interest in leather-based products.

Growth Drivers in the United Kingdom Leather Goods Market

Strong Fashion Culture, Luxury Demand, and Brand Heritage

A deep-rooted fashion culture and strong demand for luxury products remain the most influential drivers of the UK leather goods market. The country hosts globally renowned fashion houses, heritage brands, and premium designers that emphasize craftsmanship, timeless design, and superior materials. Leather handbags, footwear, wallets, and travel accessories are perceived as long-term investments rather than disposable fashion items.

Tourism plays a significant role, particularly in major cities, where international visitors contribute heavily to luxury leather sales. Seasonal fashion cycles, celebrity endorsements, and storytelling around brand heritage further reinforce consumer interest. British consumers continue to prioritize quality and durability, supporting consistent spending on premium leather goods despite economic fluctuations.

Growth of E-Commerce and Digital Retail Channels

The rapid growth of e-commerce has become a key catalyst for the UK leather goods market. Brand-owned websites, fashion marketplaces, and luxury e-commerce platforms provide consumers with convenient access to a wide range of domestic and international brands. Online shopping enhances purchase confidence through detailed product descriptions, high-resolution visuals, customer reviews, and flexible return policies.

Digital marketing, influencer collaborations, virtual try-on tools, and social commerce increasingly influence buying decisions. Direct-to-consumer models reduce reliance on physical retail and allow small and mid-sized brands to reach a national audience. Mobile shopping apps, personalized recommendations, and omnichannel strategies drive repeat purchases and customer loyalty, making online retail one of the fastest-growing sales channels in the market.

Product Premiumization, Sustainability, and Customization Trends

Premiumization and sustainability are reshaping growth dynamics in the UK leather goods market. Consumers are increasingly prioritizing high-quality, long-lasting products over short-life fashion items. This trend has boosted demand for full-grain leather, handcrafted goods, and premium designer collections.

Environmental awareness is also driving brands toward responsible sourcing, chrome-free tanning, recycled packaging, and transparent supply chains. Customization options such as monogramming, bespoke sizing, and personalized designs add perceived value and appeal to younger consumers seeking individuality. Together, premium quality, sustainability, and personalization are strengthening brand differentiation and supporting higher price points.

Challenges in the United Kingdom Leather Goods Market

Ethical, Environmental, and Regulatory Pressures

Environmental and ethical scrutiny poses a significant challenge for the UK leather goods industry. Traditional leather production involves chemical-intensive tanning processes that face increasing regulation due to environmental impact and worker safety concerns. Consumers are becoming more sensitive to animal welfare, carbon footprint, and traceability of raw materials.

To remain competitive, brands must invest in sustainable tanning technologies, wastewater treatment, and transparent supply chains, which increases production costs. Import regulations affecting raw hides and finished leather goods further complicate sourcing. Failure to align with sustainability expectations can damage brand reputation and erode consumer trust, making the balance between profitability and responsibility a key challenge.

Competition from Synthetic Alternatives and Price Sensitivity

The growing popularity of synthetic and vegan leather alternatives presents strong competition to traditional leather goods. These products are often cheaper, lightweight, and marketed as cruelty-free and environmentally friendly, appealing to price-sensitive and ethically conscious consumers. Fast-fashion brands aggressively promote low-cost faux leather products, intensifying market competition.

Fluctuations in raw leather prices and rising manufacturing costs put pressure on margins for genuine leather producers. Increased price comparison through online platforms further reduces pricing power, particularly in the mid-range segment. Emphasizing craftsmanship, durability, and heritage remains essential for traditional leather brands to maintain differentiation.

United Kingdom Leather Footwear Market

Leather footwear represents a major segment of the UK leather goods market, valued for comfort, durability, and premium appearance. Products include formal shoes, casual footwear, boots, luxury dress shoes, and specialized work or outdoor footwear. Leather’s breathability and resilience make it well-suited to the UK’s variable climate.

Demand is supported by corporate dress codes, school uniforms, and professional requirements, while fashion trends drive interest in designer sneakers and lifestyle footwear. Sustainability initiatives, such as eco-friendly tanning and recycled sole materials, are gaining importance. Online and omnichannel retail channels are increasingly contributing to footwear sales, ensuring steady replacement cycles and long-term revenue growth.

United Kingdom Genuine Leather Goods Market

The genuine leather goods segment focuses on products made from real animal hide, prized for strength, durability, and natural texture. Key products include handbags, wallets, belts, briefcases, travel accessories, and upholstery items. UK consumers associate genuine leather with authenticity, craftsmanship, and long-term value.

Heritage brands emphasizing traditional leatherworking techniques enjoy strong consumer trust. Genuine leather goods are widely used for corporate gifting and executive accessories. Despite competition from synthetic alternatives, many consumers continue to prefer genuine leather due to its classic aesthetic and aging characteristics, making this segment a cornerstone of the UK market.

United Kingdom Leather Premium Products Market

The premium and luxury leather goods segment targets high-income consumers seeking exclusivity and superior craftsmanship. Products include designer handbags, luxury footwear, premium luggage, and high-end accessories. Strong brand heritage, artisanal production, and material quality define this segment.

Consumers view premium leather goods as status symbols and long-term fashion investments. Sales are driven by flagship boutiques, luxury department stores, airport duty-free outlets, and online luxury platforms. Tourism, gifting culture, and aspirational buying behavior support resilience in this segment, even during economic uncertainty.

United Kingdom Leather Goods Mass Products Market

The mass leather goods segment caters to budget-conscious and middle-income consumers seeking functional and fashionable products at affordable prices. Offerings include everyday handbags, wallets, belts, footwear, and travel accessories, often made from split leather or blended materials.

Distribution is dominated by supermarkets, high-street retailers, discount stores, and fast-fashion outlets. Price competitiveness, frequent promotions, and trend responsiveness drive high sales volumes. Although margins are thinner, this segment contributes significantly to overall market volume and broad consumer adoption.

United Kingdom Leather Goods Departmental Stores Market

Departmental stores remain an important distribution channel by offering premium, mid-range, and mass-market leather brands under one roof. These stores provide tactile product inspection, quality assurance, and personalized service, enhancing customer confidence.

Leather handbags, footwear, belts, wallets, and luggage are key categories. Seasonal promotions, loyalty programs, and in-store displays influence purchasing behavior. Hybrid strategies such as click-and-collect help maintain relevance amid growing online competition.

United Kingdom Leather Goods Online Stores Market

Online retail is the fastest-growing channel for leather goods in the UK. Consumers benefit from convenience, transparent pricing, and wide brand accessibility. Direct-to-consumer strategies improve margins and strengthen brand control.

Advanced digital features such as 360-degree product views, virtual fitting, AI-driven recommendations, and social media integration enhance engagement. Improved logistics, flexible delivery, and return policies further boost consumer trust, making e-commerce central to future market growth.

London Leather Goods Market

London is the UK’s largest and most influential leather goods market, driven by its status as a global fashion and luxury capital. High-end shopping districts, department stores, flagship boutiques, and airport retail generate strong demand. Tourism, professional consumers, and fashion events sustain consistent sales, while sustainability-focused innovation often originates in London and influences national trends.

Manchester Leather Goods Market

Manchester’s leather goods market benefits from a young population, expanding retail infrastructure, and a vibrant fashion scene. Demand spans both premium and mass products, supported by strong online adoption and a growing creative community. Seasonal sales and fast-fashion outlets influence purchasing patterns, ensuring steady growth.

Liverpool Leather Goods Market

Liverpool’s market is supported by tourism, port-related trade, and urban regeneration. Retail developments attract visitors seeking handbags, footwear, and travel accessories. Strong logistics connectivity supports online distribution, while local consumers favor affordable, fashionable leather products.

Edinburgh Leather Goods Market

Edinburgh’s leather goods market is driven by tourism, heritage retail, and premium craftsmanship appeal. Boutique and heritage stores dominate sales, while affluent residents drive demand for premium footwear and accessories. Sustainability and artisanal branding resonate strongly, creating a high-value, quality-focused market.

United Kingdom Leather Goods Market Segmentation Overview

The market is segmented by product into footwear, luggage, and accessories; by material into genuine and synthetic leather; by price into premium and mass products; and by distribution channel into clothing and sportswear retailers, departmental stores, supermarkets and hypermarkets, online stores, and others. Major cities include London, Manchester, Birmingham, Leeds, Liverpool, Edinburgh, Glasgow, Bristol, and the rest of the UK.

Competitive Landscape and Company Analysis

The UK leather goods market features strong participation from global and regional players focusing on innovation, sustainability, and omnichannel expansion. Key companies include Adidas AG, American Leather Holdings LLC, Capri Holdings Limited, Hermès International S.A., Kering S.A., LVMH, Puma SE, Tapestry Inc., and VIP Industries. Market evaluations typically include company overviews, leadership, recent developments, SWOT analysis, and revenue trends.

Conclusion

The United Kingdom leather goods market is expected to maintain steady growth through 2034, supported by strong fashion heritage, premiumization, and expanding digital retail channels. While ethical concerns, environmental regulations, and competition from synthetic alternatives pose challenges, innovation in sustainability, customization, and omnichannel strategies continues to strengthen market resilience. Leather goods remain a vital component of the UK fashion and lifestyle economy, balancing tradition with evolving consumer expectations.