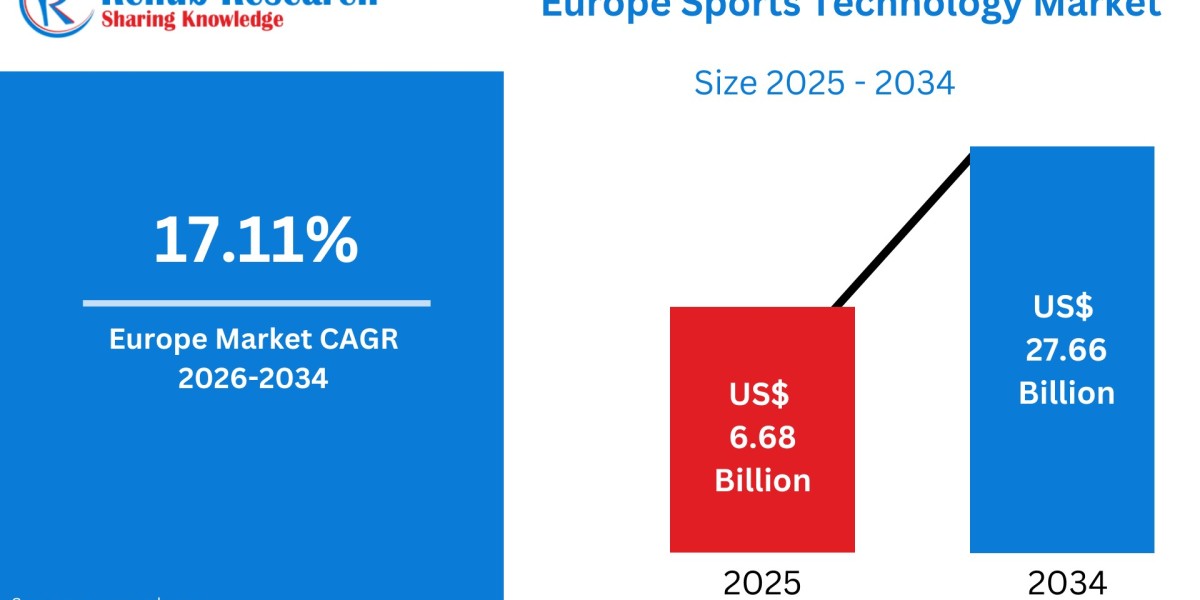

Europe Sports Technology Market Size & Forecast 2026–2034

According to Renub Research Europe sports technology market is poised for robust expansion over the next decade, reflecting the accelerating digital transformation of the region’s sports, fitness, and entertainment ecosystems. The market is projected to grow from US$ 6.68 billion in 2025 to US$ 27.66 billion by 2034, registering a strong compound annual growth rate (CAGR) of 17.11% between 2026 and 2034. This growth is being driven by widespread adoption of advanced digital solutions across professional sports organizations, fitness and wellness platforms, and fan engagement channels. Increasing investments in data analytics, wearable devices, smart stadium infrastructure, and AI-powered performance tracking are reshaping how sports are played, managed, and consumed across Europe.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=europe-sports-technology-market-p.php

Europe Sports Technology Market Outlook

Sports technology refers to the application of digital tools, software platforms, hardware systems, and data-driven methodologies designed to enhance athletic performance, training efficiency, sports management, fan engagement, and overall sporting experiences. It encompasses wearable devices, performance analytics software, video analysis systems, smart sports equipment, virtual and augmented reality training tools, injury prevention technologies, and intelligent stadium solutions. These technologies support athletes in improving strength, endurance, tactics, and recovery, while enabling coaches, teams, and organizations to make evidence-based decisions using real-time and predictive data.

Europe’s strong sports culture provides fertile ground for the adoption of sports technology. Football, athletics, cycling, motorsports, rugby, and fitness activities have deep-rooted popularity across the region. Professional clubs, leagues, and academies increasingly rely on analytics, wearables, and artificial intelligence to gain competitive advantages. At the same time, the rise of connected fitness devices and mobile health applications has expanded adoption among recreational athletes and fitness-conscious consumers. Smart stadiums, digital ticketing, and immersive fan engagement platforms are also redefining the live sports experience, driving sustained demand for innovative sports technology solutions across Europe.

Growth Drivers in the Europe Sports Technology Market

Professionalization of Sports and Performance Optimization

One of the most significant growth drivers in the Europe sports technology market is the increasing professionalization of sports at all levels. Elite clubs, national teams, and training academies are investing heavily in technologies that enhance performance, reduce injury risk, and extend athlete careers. Wearable sensors, GPS trackers, biomechanical analysis tools, and video analytics systems provide detailed insights into workload, movement patterns, and tactical behavior.

Coaching staff use centralized dashboards to monitor training intensity, recovery cycles, and match readiness in real time. In highly competitive sports such as football, rugby, basketball, and athletics, marginal performance improvements can determine outcomes. As a result, technology is no longer viewed as optional but as a strategic differentiator. Clubs are increasingly allocating budgets for sports science departments, analytics teams, and integrated technology ecosystems to maintain long-term competitiveness.

Digital Fan Engagement, Media Innovation, and Commercialization

Another major driver of market growth is the evolution of fan engagement and sports media consumption. European leagues and clubs are expanding their global reach through digital platforms, aiming to monetize content and strengthen fan loyalty. Sports technology enables live data overlays, advanced broadcast graphics, second-screen experiences, fantasy sports integration, and personalized content delivery.

Mobile applications, social media platforms, and over-the-top streaming services allow fans to follow teams and athletes from anywhere in the world. This has increased demand for real-time statistics, interactive features, and immersive highlights. Smart stadium technologies, including digital ticketing, mobile food ordering, augmented reality experiences, and high-density connectivity, enhance the matchday experience while generating valuable fan behavior data. These capabilities support new revenue streams and reinforce the commercial value of sports technology.

Growth of Fitness, Wellness, and Connected Consumer Devices

Beyond professional sports, Europe’s growing emphasis on health, fitness, and wellness is significantly boosting sports technology adoption. Consumers increasingly use smartwatches, fitness trackers, connected gym equipment, and mobile applications to monitor physical activity, heart rate, sleep quality, and calorie expenditure. Home fitness platforms, virtual coaching services, and gamified workout experiences combine convenience with motivation, attracting users across all age groups.

Sports technology has effectively bridged the gap between elite athletic performance and everyday fitness. Metrics that were once exclusive to professional athletes are now accessible to recreational users. Gyms, fitness clubs, and personal trainers integrate connected devices and apps into their programs to track progress and deliver personalized training plans. This consumer-driven demand is creating a large installed base of IoT devices and subscription-based services, fueling continuous innovation across the market.

Challenges in the Europe Sports Technology Market

High Costs, ROI Uncertainty, and Budget Constraints

Despite strong growth prospects, the high cost of advanced sports technology remains a major barrier, particularly for smaller clubs, amateur organizations, and grassroots sports programs. High-end systems such as optical tracking cameras, virtual reality simulators, and integrated analytics platforms require substantial upfront investment, ongoing maintenance, and specialized personnel.

Quantifying return on investment can be challenging, especially for outcomes like injury prevention or youth development that yield long-term benefits rather than immediate financial returns. Budget constraints in lower leagues often limit adoption, creating a technology gap between elite and grassroots sports. Vendors are increasingly responding with modular solutions, subscription-based pricing, and clearer performance metrics to address these concerns.

Data Privacy, Integration Complexity, and Skills Gap

Sports technology generates large volumes of sensitive data related to athletes, fans, and operational activities. Ensuring data privacy, cybersecurity, and regulatory compliance is increasingly complex, particularly when dealing with biometric data or youth athletes. Integrating multiple systems—such as wearables, video analysis platforms, ticketing solutions, CRM systems, and analytics tools—into a unified ecosystem is technically demanding and costly.

Many sports organizations lack in-house expertise in data management, analytics, and IT infrastructure. Coaches and support staff may also feel overwhelmed by complex dashboards if not properly trained, leading to underutilization of technology. Cultural resistance among traditional coaching environments can further slow adoption, highlighting the need for education and change management.

Europe Sports Technology Software Market

The software segment forms the backbone of the Europe sports technology market by transforming raw data into actionable insights. Performance analytics platforms aggregate data from wearables, GPS trackers, video systems, and match events to support tactical analysis, load management, scouting, recruitment, and rehabilitation monitoring. These platforms enable data-driven decision-making across coaching, medical, and performance teams.

On the commercial side, software solutions manage fan engagement, ticketing, memberships, content distribution, and marketing campaigns. Cloud-based deployment has become increasingly common, allowing collaboration across locations and devices. Broadcasters rely on specialized software for real-time graphics, statistics, and replay analysis, further strengthening demand for advanced sports technology software across Europe.

Europe Sports Technology Services Market

The services segment includes consulting, systems integration, data analytics, sports science support, and managed operations. Many clubs, federations, and fitness organizations rely on external experts to select, implement, and optimize technology solutions. Service providers design data strategies, integrate hardware and software, and ensure interoperability with existing infrastructure.

Sports scientists and performance consultants interpret data to provide training recommendations, injury prevention strategies, and recovery protocols. Analytics services also support scouting, recruitment, and opposition analysis, particularly for clubs without large in-house analytics teams. Training and education services are essential to help coaches, athletes, and staff effectively use new technologies.

Europe IoT Sports Technology Market

The Internet of Things segment includes wearable devices, smart sports equipment, connected gym machines, stadium sensors, and networked training environments. European teams widely use GPS vests, heart-rate monitors, inertial sensors, and smart insoles to capture real-time movement and physiological data. Smart balls, rackets, and bicycles provide detailed performance feedback, while connected gym machines automatically log workouts and adjust resistance.

In stadiums, IoT sensors monitor crowd flow, environmental conditions, and asset performance, enhancing safety and operational efficiency. For consumers, wearable fitness devices and connected apps encourage daily engagement with physical activity. Reliable connectivity, long battery life, comfort, and secure data handling are critical success factors for IoT-based sports technologies.

Europe Soccer Sports Technology Market

Football is the dominant sport driving sports technology adoption in Europe. Leading clubs and national teams invest heavily in player tracking systems, video analytics platforms, sports science tools, and scouting databases. Data collected during training and matches is used to optimize tactics, manage physical load, and prevent overuse injuries.

Advanced video analysis tools provide granular insights into team shape, pressing strategies, set-piece execution, and opponent tendencies. Recruitment departments increasingly rely on data-driven scouting models to identify undervalued talent globally. Fan-facing technologies such as interactive applications, augmented reality experiences, and advanced broadcast graphics further enhance engagement and brand reach, making soccer a cornerstone of the Europe sports technology market.

Europe Cricket Technology Market

Cricket technology in Europe remains more specialized but continues to grow steadily in regions with strong participation, including the United Kingdom and Ireland. Technologies include ball-tracking systems, high-speed cameras, performance analytics software, and training tools for batting, bowling, and fielding. Wearable sensors help manage bowler workloads and reduce injury risk.

Broadcast innovations such as predictive graphics, field maps, and real-time statistics enhance viewer understanding, particularly in shorter formats like T20 cricket. Grassroots clubs are also adopting scoring apps, live-streaming tools, and coaching software, supporting gradual market expansion.

Europe Analytics and Statistics Sports Technology Market

Analytics and statistics underpin modern sports decision-making in Europe. Event data, tracking metrics, and contextual information are used to evaluate player performance, tactical effectiveness, and team strategies. Recruitment teams use statistical models to assess transfer targets and identify hidden value in the player market.

On the commercial side, analytics support ticket pricing, fan segmentation, sponsorship valuation, and content optimization. Progressive clubs and leagues are building dedicated data science teams, while vendors offer customizable analytics platforms to meet diverse organizational needs.

Europe Sports Training Technology Market

Sports training technology in Europe focuses on skill development, technique refinement, and tactical understanding. Tools such as video coaching platforms, motion capture systems, virtual and augmented reality simulators, and interactive training walls enable athletes to practice scenarios repeatedly and receive instant feedback.

Youth academies use training technology to standardize development pathways and accelerate learning. In individual sports such as tennis, golf, and athletics, biomechanical analysis improves technique while reducing injury risk. Team sports benefit from tactical simulators and video sessions that enhance game intelligence and decision-making.

Country-Level Insights: France, United Kingdom, and Germany

France’s sports technology market is shaped by strong traditions in football, rugby, cycling, and Olympic sports. Professional teams and national institutes invest heavily in performance analytics, biomechanics, and sports science. Digital fan engagement platforms and enhanced broadcast solutions are widely adopted to strengthen supporter connections.

The United Kingdom represents one of Europe’s most mature sports technology markets, driven by football, cricket, rugby, tennis, and Olympic programs. Premier League clubs invest heavily in analytics, tracking, and injury prevention tools, while the country also hosts a vibrant ecosystem of sports technology startups.

Germany’s sports technology market benefits from strong engineering expertise, structured leagues, and close collaboration between clubs, universities, and technology companies. Bundesliga clubs are early adopters of tracking and analytics systems, while sports such as handball, winter sports, athletics, and motorsports leverage precision measurement and engineering-led innovation.

Competitive Landscape and Company Analysis

The Europe sports technology market is highly competitive, with global and regional players offering integrated solutions across performance, analytics, and fan engagement. Key companies include Catapult Group International Ltd., Garmin Ltd., Infosys Limited, International Business Machines Corporation, Oracle Corporation, Pixellot Ltd., SAP SE, Stats Perform, and Zebra Technologies Corporation. Each company is evaluated across five viewpoints—overview, key personnel, recent developments, SWOT analysis, and revenue performance—highlighting the innovation-driven and competitive nature of the European sports technology market.