IMARC Group has recently released a new research study titled “South Korea Data Center Market Report by Data Center Size (Large, Massive, Medium, Mega, Small), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Absorption (Non-Utilized, Utilized), and Region 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Data Center Market Overview

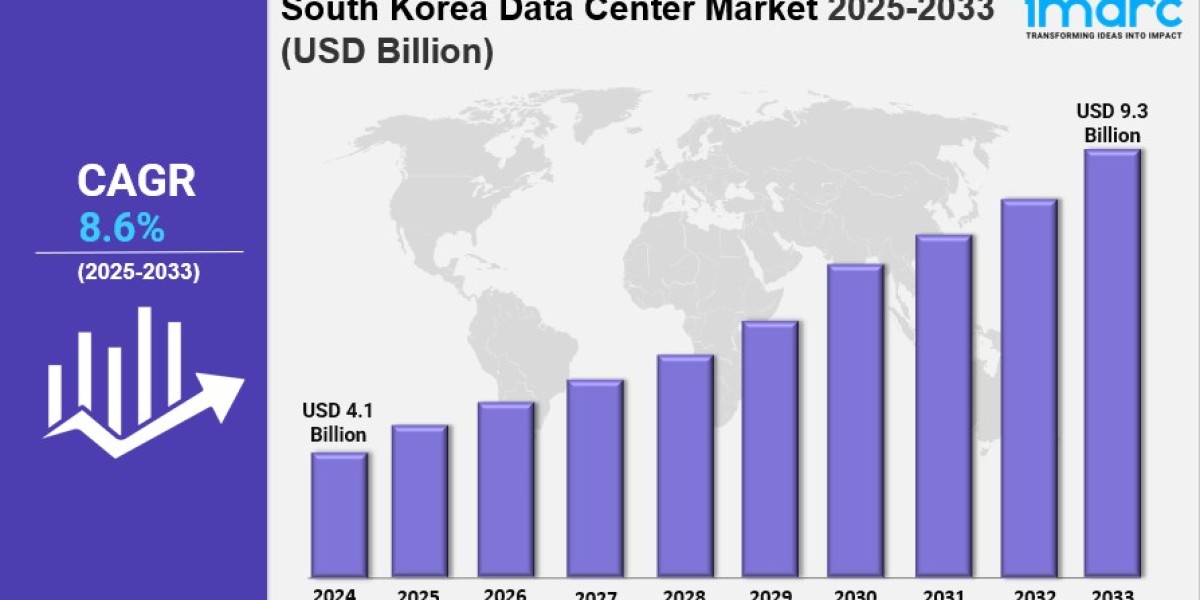

The South Korea Data Center Market size reached a market of USD 4.40 Billion in 2025. It is projected to grow at a CAGR of 8.69% during the forecast period of 2026 to 2034, reaching a value of USD 9.30 Billion by 2034. The market growth is primarily driven by rising demand for cloud computing services across the country.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

South Korea Data Center Market Key Takeaways

- Current Market Size: USD 4.40 Billion in 2025

- CAGR: 8.69%

- Forecast Period: 2026-2034

- The rising number of smart cities is propelling market growth.

- Transformation initiatives by government entities and private enterprises significantly boost the market.

- Expanding telecommunications infrastructure characterized by high-speed internet connectivity enhances market growth.

- Energy-efficient designs are increasingly popular in the Yeongnam region, while eco-friendly practices propel the market in Honam.

- Concerns about high energy consumption pose challenges, but the integration of renewable energy sources presents growth opportunities.

Sample Request Link: https://www.imarcgroup.com/south-korea-data-center-market/requestsample

Market Growth Factors

The South Korea data center market is driven by the increasing number of smart cities within the country. This rapid urban development supports increased demand for data storage and processing capabilities, fueling overall industry growth. Furthermore, transformation initiatives undertaken by both government entities and private enterprises have emerged as vital growth-inducing factors. These initiatives align with the country's ambition to enhance digital infrastructure, which further stimulates market expansion.

Additionally, the market benefits greatly from the expansion of telecommunications infrastructure widely characterized by high-speed internet connectivity. This robust connectivity facilitates cloud computing services and digital content demand, therefore driving data center investments. The market is also witnessing an expansion of high-density data centers designed to handle more data in smaller physical spaces through advanced cooling and energy management systems, which encourage adoption.

Sustainability and green initiatives play a crucial role in shaping the market. Data centers are adopting renewable energy sources and energy-efficient technologies to minimize carbon footprints and reduce operating costs. Government plans announced in 2024 for a 1-gigawatt data center hub in Donghae and Gangneung capable of hosting 50 data centers highlight a strong regulatory focus on sustainability. These moves align with global and local environmental regulations, presenting significant opportunities despite challenges posed by high energy consumption.

Market Segmentation

Breakup by Data Center Size:

- Large

- Massive

- Medium

- Mega

- Small

Large and massive data centers typically serve major corporations and cloud service providers with extensive computing and storage capabilities. Medium-sized centers cater to regional enterprises and service providers. Mega data centers support the increasing demand for digital content and cloud services using cutting-edge cooling and energy efficiency technologies. Small data centers often serve specific industries or local businesses, focusing on low latency and proximity.

Breakup by Tier Type:

- Tier 1 and 2

- Tier 3

- Tier 4

Tier 1 and 2 data centers are frequently used by smaller businesses or less critical applications, offering limited redundancy and uptime guarantees. Tier 3 centers provide a balance between reliability and cost, featuring multiple paths for power and cooling for consistent enterprise performance. Tier 4 data centers offer the highest security and reliability with fault-tolerant systems and fully redundant infrastructure designed for zero downtime.

Breakup by Absorption:

- Non-Utilized

- Utilized

- Colocation Type: Hyperscale, Retail, Wholesale

- End User: BFSI, Cloud, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, Others

Non-utilized spaces represent data center areas not yet leased or activated. Hyperscale colocation serves tech giants and large cloud providers with vast capacity and scalability. Retail colocation is cost-effective and flexible for smaller enterprises. Wholesale colocation appeals to medium-sized businesses seeking a middle ground.

Breakup by Region:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report also covers all major regional markets including Seoul Capital Area, which benefits from favorable investment environments, Yeongnam with its strategic industrial locations, Honam’s emerging attractiveness, and Hoseo’s focus on research institutions.

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=19824&flag=C

Regional Insights

The dominant region in the South Korea data center market is the Seoul Capital Area, where demand is bolstered by the conducive environment for data center investments. Yeongnam (Southeastern Region) also stands out with its strategic location near industrial zones and rising popularity of energy-efficient data centers. Additionally, Honam (Southwestern Region) is driving the market with increased adoption of eco-friendly practices. Hoseo (Central Region) is growing due to research institutions, collectively expanding the market across these key areas.

Recent Developments & News

- In September 2024, Empyrion Digital signed a binding agreement with one of Japan’s largest diversified financial services groups to develop a 25MW AI-ready data center, escalating market outlook.

- In August 2024, South Korea Investment Real Asset Management Co. and Indonesian conglomerate Sinar Mas formed a joint venture to build a hyperscale data center in Jakarta’s central business district in a US$300 Million project, expanding market share.

- In February 2024, South Korean regulatory authorities announced plans for a 1-gigawatt data center hub near Donghae and Gangneung, capable of accommodating up to 50 data centers with an average capacity of 20MW each.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302