Introduction

The Ready Meals Market represents the global industry focused on the production, packaging, and distribution of fully or partially prepared food products designed for quick consumption. These meals require minimal preparation, typically involving heating or simple assembly. Ready meals include frozen, chilled, shelf-stable, and ready-to-eat formats tailored to modern lifestyles.

The market holds strong global importance due to changing consumer behavior, urbanization, and increasing demand for convenient food solutions. Rising work hours, smaller household sizes, and the growing number of dual-income families contribute to consistent demand for ready meals across both developed and developing economies.

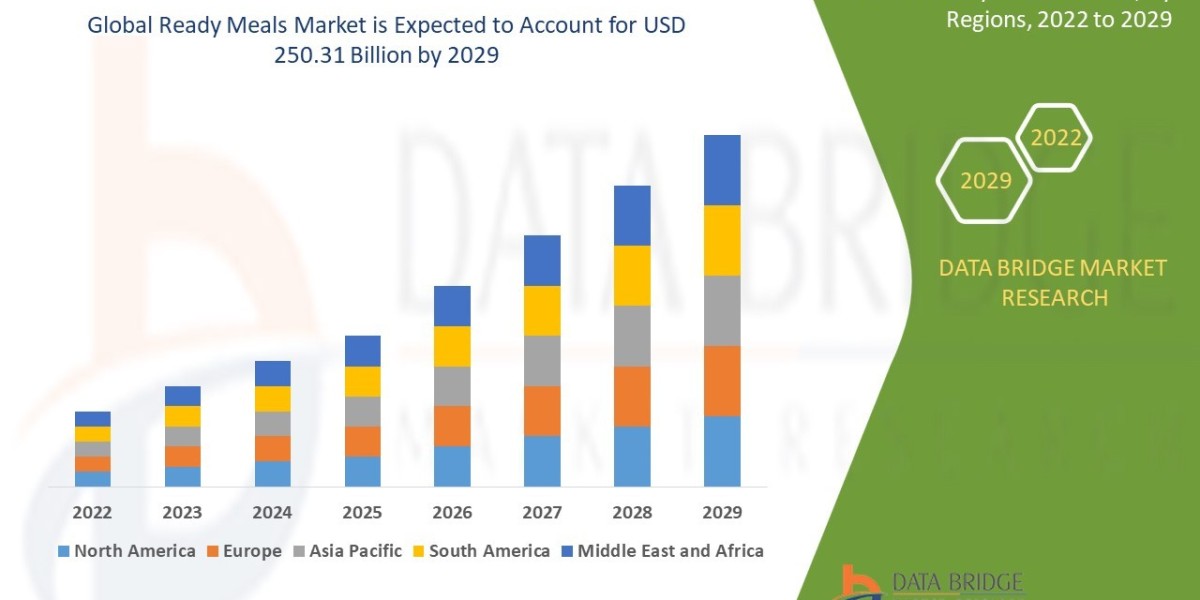

As of 2024, the global ready meals market is estimated to be valued at USD 165 billion, reflecting widespread adoption across retail, foodservice, and online distribution channels. The market remains highly relevant due to evolving dietary preferences, technological improvements in food preservation, and expanding availability of diverse cuisines.

The Evolution of the Ready Meals Market

The ready meals market evolved significantly during the mid-20th century with the development of frozen food technologies. Early innovations focused on military rations and institutional food services, which later transitioned into consumer markets. The introduction of home freezers accelerated adoption in North America and Europe.

During the 1980s and 1990s, microwave ovens became widely available, creating strong demand for microwaveable ready meals. Food manufacturers expanded product portfolios to include frozen dinners, canned meals, and instant foods with extended shelf life.

Key milestones included advancements in freezing methods, modified atmosphere packaging, and aseptic processing. These technologies improved food safety, taste retention, and storage efficiency. Branding and packaging innovations also increased consumer trust and market penetration.

Demand patterns shifted as consumers began prioritizing quality, nutrition, and variety. The market transitioned from basic convenience foods to premium, health-oriented, and culturally diverse meal options. Technology-driven production processes enabled mass customization and improved supply chain efficiency.

Market Trends

Consumer trends indicate rising preference for convenience without compromising taste or nutritional value. Busy lifestyles and urban living support steady demand for ready meals across age groups. Single-serve and portion-controlled meals gain popularity among working professionals and elderly consumers.

Health-conscious consumption shapes product development strategies. Demand increases for low-calorie, high-protein, plant-based, and allergen-free ready meals. Clean-label products with transparent ingredient sourcing attract informed consumers.

Technology adoption strengthens product quality and market reach. Automation in food processing enhances consistency and scalability. Smart packaging solutions improve shelf life monitoring and food safety assurance. Cold chain logistics expansion supports global distribution.

Regional adoption patterns differ based on cultural eating habits and economic conditions. North America and Europe show high penetration of frozen and chilled ready meals. Asia-Pacific demonstrates rapid growth driven by urban expansion, rising disposable income, and acceptance of Western-style food formats. Latin America and the Middle East & Africa experience gradual adoption supported by retail infrastructure growth and changing dietary habits.

Challenges

The ready meals industry faces regulatory challenges related to food safety standards, labeling requirements, and nutritional disclosures. Compliance varies across regions, increasing operational complexity for multinational manufacturers.

Economic challenges include fluctuating raw material prices, energy costs, and labor expenses. Profit margins remain sensitive to supply chain disruptions and inflationary pressures.

Supply chain challenges affect sourcing, cold storage, and distribution efficiency. Perishable ingredients require strict temperature control, increasing logistics costs. Packaging waste management adds environmental and regulatory pressure.

Key barriers to growth include consumer perception regarding freshness and nutritional value. Risks include product recalls, food contamination incidents, and growing competition from fresh meal kits and food delivery services.

Market Scope

Segmentation by Product Type

Frozen ready meals

Chilled ready meals

Shelf-stable and canned meals

Ready-to-eat meals

Frozen ready meals dominate the market due to long shelf life and wide product availability.

Segmentation by Meal Type

Vegetarian and vegan meals

Non-vegetarian meals

Plant-based alternatives

Ethnic and regional cuisine meals

Ethnic and international cuisines show strong growth due to globalization and cultural diversity.

Segmentation by Distribution Channel

Supermarkets and hypermarkets

Convenience stores

Online retail platforms

Foodservice outlets

Supermarkets remain the primary distribution channel, while online sales grow rapidly.

Regional Analysis

North America

High consumption levels supported by busy lifestyles and strong cold chain infrastructure.

Europe

Mature market with emphasis on premium, organic, and nutritionally balanced meals.

Asia-Pacific

Fastest-growing region driven by urbanization, Western food adoption, and e-commerce growth.

Latin America

Emerging market with increasing retail penetration and rising middle-class population.

Middle East & Africa

Developing adoption supported by urban expansion and international food brands.

End-User Industries

Retail consumers

Corporate catering services

Healthcare institutions

Hospitality and travel sectors

Market Size and Factors Driving Growth

The global ready meals market reached an estimated value of USD 165 billion in 2024. The market is projected to expand at a compound annual growth rate (CAGR) of approximately 6.4% between 2025 and 2035. By 2035, the market value is expected to surpass USD 305 billion.

Key growth drivers include urban population growth, rising disposable income, and changing dietary habits. Technological advancements in food preservation, packaging, and automation support large-scale production and global distribution.

Sustainability initiatives influence product development, including eco-friendly packaging and reduced food waste. Government policies promoting food safety and nutritional awareness shape product standards and labeling practices.

Emerging regions offer strong growth opportunities due to expanding retail infrastructure and increasing acceptance of convenience foods. Localization of flavors and pricing strategies enhances market penetration in developing economies.

Conclusion

The ready meals market shows sustained growth driven by evolving consumer lifestyles and advancements in food technology. Demand for convenience, variety, and quality positions ready meals as a core segment within the global food industry.

Innovation remains critical in addressing nutritional concerns, sustainability goals, and taste expectations. Investment in clean-label formulations, packaging efficiency, and digital distribution channels strengthens competitive positioning.

Future opportunities exist across emerging markets, premium product segments, and plant-based meal solutions. Stakeholders focusing on adaptability, innovation, and responsible sourcing will shape long-term market success.

Frequently Asked Questions (FAQ)

What are ready meals?

Ready meals are pre-prepared food products designed for quick consumption with minimal cooking or preparation.

Which factors drive the ready meals market?

Urbanization, busy lifestyles, rising disposable income, and advancements in food preservation technologies drive market growth.

What types of ready meals are most popular?

Frozen and chilled ready meals are most popular due to convenience, variety, and extended shelf life.

Which region leads the ready meals market?

North America leads the market, while Asia-Pacific shows the fastest growth rate.

How is sustainability influencing the ready meals industry?

Sustainability drives eco-friendly packaging, waste reduction initiatives, and clean-label product development.