The Kingdom of Thailand, with its capital Bangkok, is bounded by the Pacific Ocean to the southeast and the Gulf of Thailand to the southeast and the Indian Ocean and the Sea of Myanmar to the southwest. It borders Myanmar to the west and northwest, Laos to the northeast, Cambodia to the east, and Malaysia to the south. The total area is 513,000 square kilometers, the coastline is 2,705 kilometers, and the total population is 67.9 million people. More than 90% of the people believe in Buddhism, and Thai is the national language.

Thailand is one of the emerging industrial countries and market economies. It implements liberal economic policies and is an export-oriented economy. It is a member and founding country of ASEAN. It is located in the center of ASEAN. The society is generally stable, the policy transparency and trade liberalization are relatively high, and the business environment is open and inclusive. It is the second largest economy in ASEAN, has strong radiation ability to neighboring countries, has good economic growth prospects, and has large market potential.

Thailand is a typical export-oriented economy, and its exports account for more than 60% of Thailand's gross domestic product (GDP). China, Japan, the United States, and the European Union are Thailand's important trading partners. Thailand's economic size has long been ranked second among ASEAN member states. Thailand's GDP in 2024 will be approximately US$526.8 billion, surpassed by Singapore and falling to third among ASEAN members, with per capita GDP of approximately US$7,500.

2. Overview of Thailand’s steel industry

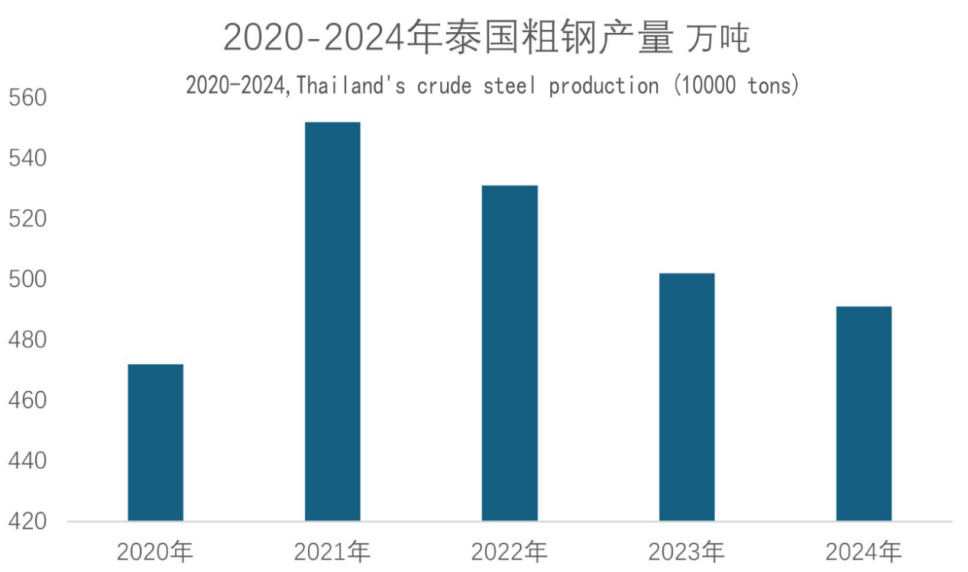

According to statistics released by the World Steel Association, Thailand's crude steel output in 2024 will be 4.918 million tons, a year-on-year decrease of 1.17%, ranking 27th in the world, and fourth among ASEAN countries, after Vietnam, Indonesia and Malaysia. From the perspective of finished product structure, in 2024, Thailand's long product production will account for about 62% of the total domestic steel production, flat products will account for about 34%, and pipes and other products will account for about 4%.

Thailand's steel industry shows an obvious agglomeration effect in terms of geographical distribution, mainly concentrated in the central, eastern and northeastern regions. Data show that the steel production in central Thailand accounts for 36.5%, the eastern region accounts for 26.4%, the northeastern region accounts for 18.7%, the northern region accounts for 12.3%, and the southern region accounts for 6.1%.

This geographical distribution characteristic is closely related to Thailand’s industrial layout and infrastructure conditions. As Thailand's traditional industrial center, the central region has complete infrastructure and convenient transportation, attracting a large number of steel companies. The eastern region benefits from the advantages of coastal deep-water ports, which facilitate the import of raw materials and export of products, which is especially important for steel companies that rely on imported raw materials.

(1) Weicheng Fat Steel Industrial Co., Ltd.

The company's production capacity is about 4 million tons per year, and it owns electric furnaces, slab continuous casters, 1300 mm hot rolling mills, cold rolling mills, coating production lines, electro-galvanizing production lines, pickling production lines, etc. The hot rolling mill is equipped with one rough rolling stand and six finishing rolling stands, with a maximum coil weight of 31 tons and an annual output of 2.4 million tons. Product specifications are 1-19 mm thick and 900-1550 mm wide hot-rolled strip coils. There are also two bar rolling mills with a total production capacity of 720,000 tons/year. There is also a small section rolling mill.

(2) Bangkok Steel Industries Company

The company can produce 300,000 tons of steel annually. Equipped with two 25-ton electric furnaces, the total production capacity is 300,000 tons/year. One 2-strand billet continuous caster (large specification: 180 mm), and one 3-strand billet continuous caster (large specification: 130 mm), with a total production capacity of 450,000 tons/year. A 9-stand bar rolling mill with a production capacity of 180,000 tons/year. An 18-stand horizontal/vertical continuous rolling mill can produce 250,000 tons of bars per year. In addition, there are two hot-dip galvanizing production lines with a total production capacity of 110,000 tons/year. A color coating production line with a production capacity of 20,000 tons/year.

(3) Tata Steel Thailand

The company was formed after India's Tata Steel acquired Thailand's Millennium Company and other Thai companies took shares. The company mainly produces long products, with a production capacity of 1.7 million tons/year, and has the following subsidiaries:

①Siam Steel Company, with a production capacity of 350,000 tons/year, has a 40-ton and a 30-ton electric furnace, two 4-strand billet continuous casters, an 18-stand bar rolling mill, and a 27-stand wire rod rolling mill. Machine, the products are 120,000 tons/year of wire rods with a diameter of 5.5-16 mm, 64,000 tons/year of rebar, 27,000 tons/year of bars with a diameter of 12-32 mm, and 6,600 tons/year of small bars.

②NTS Steel Group. It mainly has an 80-ton electric furnace, a 72MVA transformer, an 80-ton ladle furnace, and a billet continuous casting machine with a specification of 150 mm. It also has one bar and one wire rod rolling mill, with a total production capacity of 800,000 tons/year.

③Siam Construction Steel Company. It has a 70-ton electric furnace and a ladle furnace, with a production capacity of 540,000 tons/year. Danieli provides a billet continuous casting machine with a production capacity of 120 mm billet and a production capacity of 520,000 tons/year. One bar rolling mill, 6 rough rolling stands, 6 intermediate rolling stands, 6 finishing rolling stands, with a production capacity of 500,000 tons/year.

(4) Chonban Industrial Co., Ltd.

The company's crude steel production capacity is 1.8 million tons/year. Its main equipment includes a set of direct reduced iron equipment with a production capacity of 500,000 tons/year, an AC electric furnace with a production capacity of 1.5 million tons/year, two 180-ton ladle furnaces, and a VOD furnace with a processing capacity of 1.5 million tons/year. A set of CSP continuous casting and rolling production line, the thin slab is 60-70 mm thick and 900-1600 mm wide. The rolling mill is a 1600 mm rough rolling stand (4-spoke type) and 6 finishing rolling stands with CVC thickness automatic control, with a production capacity of 1.5 million tons per year. 1 1600mm leveling machine. A hot-dip galvanized coil production line with a capacity of 800,000 tons/year.

(5)Thailand Special Steel Industry Co., Ltd.

The company has a high-end furnace with a production capacity of 3.4 million tons/year, two 170-ton alkaline converters, two 170-ton ladle furnaces, a vacuum degassing device, two 6-strand billet continuous casters with a production capacity of 1.23 million tons/year, and a bar rolling mill. The company's main products are pig iron, billets, wire rods and bars.

(6)Nambeng Steel Company

The company's annual crude steel output is 350,000 tons/year. The main equipment includes 70-ton ABB electric furnace and ladle furnace. The rolling equipment includes a bar and wire rod rolling mill with 8 cantilever stands and 10 finishing rolling stands. The maximum coil weight is 2 tons and can produce 150,000 tons of bars and 150,000 tons of wire rods per year. The minimum specification of wire is 5.5 mm in diameter, and the maximum specification of rod is 40 mm in diameter.

(7)Thailand Rod Steel Company

The company has three 20-ton electric furnaces with a production capacity of 150,000 tons per year. A 3-stream billet 5$ casting machine and a bar rolling mill with a capacity of 150,000 tons/year.

(8)UMC Metals Corporation

The company has a 70-ton electric furnace and a ladle furnace, and a Danieli 5-strand billet continuous caster with a production capacity of 380,000 tons/year and a billet size of 100-150 mm. 1 bar and wire rod rolling mill with a production capacity of 220,000 tons/year.

(9)Bangkok Steel Company

The company owns two 25-ton electric furnaces. 1 set of 3-strand billet continuous casting machine. There are two small steel rolling mills with a total production capacity of 250,000 tons/year and one wire rod rolling mill with a production capacity of 250,000 tons/year.

(10) Siam Syndicate Steel Company

The company owns a 20-ton electric furnace and a 3-stream Mitsubishi billet continuous casting machine. A bar and wire rod rolling mill with a production capacity of 120,000 tons/year. There is also a welded pipe unit.

(11)Siam/Yamato Steel Company

The company owns an electric furnace with a capacity of 600,000 tons/year provided by Danieli and a bloom/isotropic billet continuous casting machine provided by Mitsubishi Heavy Industries. There is also a large steel rolling mill.

(12) LPM Steel Plate Company

The company has a production capacity of 500,000 tons/year. It has a 4-spoke Steckel rolling mill, and its products are medium plates with a thickness of 20-39 mm and thick plates with a thickness of over 40 mm.

(13)Siam Strip Steel Company

The company owns three 130-ton electric furnaces, as well as continuous casting machines, rolling mills, etc. The product is hot-rolled coils, with a production capacity of 1.8 million tons/year.

(14)Thailand Cold Rolled Plate Company

The company can produce 1 million tons of cold-rolled plates per year. It is a joint venture between Japan's Nippon Steel and South Korea's POSCO, with Nippon Steel holding 87.7% of the shares.

(15) Nippon Steel & Sumitomo Metal Galvanizing (Thailand) Co., Ltd.

It can produce 360,000 tons of automotive sheets per year, and galvanized substrates are provided by the nearby Siam Steel Company.

(16) POSCO Coating (Thailand) Company

It can produce 400,000 tons of automotive sheets annually.

(17)Thailand Tinplate Manufacturing Company

The company can produce 360,000 tons of tin plate annually and is a joint venture between Japan and Thailand.

(18) BHP (Thailand) Steel Company

It has a reversible cold rolling mill with a capacity of 300,000 tons/year. 1 continuous hot-dip galvanized coil production line with a production capacity of 150,000 tons/year. A continuous color coating production line with a production capacity of 60,000 tons per person-year. 1 pickling line with a capacity of 350,000 tons/year.

(19) Sangkasi Thailand Company

The company has 1 color-coated board production line.

(20)Siam United Steel Company

It has a 5-stand cold-rolled strip production line manufactured by Hitachi, with a production capacity of 1 million tons per year.

(21) Thailand Coated Steel Plate Company

The company has a 1550 mm electroplated galvanized coil production line with a production capacity of 135,000 tons/year.

(22)Thailand Cold Rolled Steel Plate Company

This is a Japanese-owned enterprise. It has a cold rolling production line with a capacity of 1 million tons/year and a flattening production line.

(23) Taigang Company

The company owns two 1500 mm Sendzimir 20-spoke cold rolling mills to produce stainless steel and other steel strips. One bright strip annealing production line, one smoothing line, two slitting lines, one cross-cutting production line, and one austenitic and pearlitic stainless steel annealing and pickling line. The production capacity is 160,000 tons/year, and the product specifications are 0.25-3.0 mm thick and 1350 mm wide.

(24)Thailand Steel Pipe Industry Company

The company has two 2-inch, one 1.5-inch, and one 4-inch welded pipe production lines, with a total production capacity of 60,000 tons per year. There are also galvanized wires.

(25) Tai-Ya Steel Pipe Company

The company has steel pipe and galvanized pipe production equipment.

(26) Thai-German Steel Company

The company has stainless steel welded pipe equipment.

(27) Thailand Iron Works Company

The company has three hot-dip galvanized strip production lines with product widths of 700-1000 mm and a production capacity of 90,000 tons per year. 1 color-coated board production line with a production capacity of 17,000 tons/year.

(28) Chinese-funded enterprises

China Delonghi Company has built a hot-rolled strip production line in Rayong Industrial Park, Thailand, with a production capacity of 600,000 tons/year, including 300,000 tons/year of plain carbon steel, 150,000 tons/year of high-quality carbon steel, and 150,000 tons/year of low-alloy steel.

Sinosteel Stainless Steel Pipe is one of largest Stainless Steel Pipe and Special Alloy Pipe manufacturer in china.

Thailand's steel industry chain shows the characteristics of "weak at both ends and strong in the middle":

Upstream raw material supply: Thai steel companies mainly rely on imported iron ore, scrap steel and other raw materials, and domestic raw material supply is insufficient. Thailand's mineral resources are limited. The quantity of domestic iron ore is small, the resource grade is low, and the mining technology is relatively backward, making it difficult to meet the development of the country's steel industry. At the same time, the development history of Thailand's steel industry has resulted in few upstream iron ore and midstream steel semi-finished products manufacturing companies, and most of the factories' semi-finished products are only used for internal supply, while downstream production companies can only rely on imports.

Midstream production and processing: Midstream steel production operations include slabs, ingots, billets and other blooms. The overcapacity problem of Thailand's midstream steel products is particularly serious, especially for products such as hot-rolled steel coils, with a capacity utilization rate of only about 30%. The Thailand Investment Promotion Board has suspended investment incentives for midstream steel production businesses and no longer encourages new projects.

Downstream finished product manufacturing: Downstream steel production includes high-strength downstream steel production business (such as high-tensile steel), industrial long product production business (section steel, steel shafts, steel wires, etc.), long product production business for construction engineering, and industrial and construction plate production business.

The development history of Thailand's steel industry shows that the country initially focused on downstream industries such as the production of finished products such as steel bars and steel pipes. Subsequently, the midstream smelting industry gradually emerged, mainly based on electric furnace steelmaking, producing billets and slabs, with limited production capacity growth and reliance on imports. Demand from the construction and automotive industries has a significant impact on the steel market, giving imported steel a larger share of the Thai market.

5. Thailand steel market demand

(1) Overview of steel demand

Thailand's steel consumption demand mainly comes from the two major fields of construction and automobile manufacturing. According to data from the Federation of Thai Industries, up to 60% of steel products are used in the construction industry, 30% are used in the automotive industry, and the remaining 10% are used in manufacturing industries such as electrical appliances and machinery equipment.

Thailand's apparent steel consumption will be 18.5 million tons in 2021, 16.7 million tons in 2023, and 14.65 million tons in 2024. In 2025, the Thai Iron and Steel Association predicts that Thailand's apparent steel consumption will increase from 14.65 million tons last year to 16.17 million tons, a year-on-year increase of 10.3%. This growth is mainly due to strong demand from Thailand's automobile manufacturing industry and rising demand from Thailand's construction industry since the second quarter of 2025.

The absolute value of Thailand's per capita crude steel consumption is still at a low level, and there is high room for growth. With the implementation of the "Thailand 4.0" policy and increased investment in infrastructure construction projects, Thailand's steel demand is expected to continue to grow. Especially in the context of the government's vigorous promotion of infrastructure investment and construction, the construction industry will provide stable demand support for the steel industry.

(2) Demand outlook

On the whole, it is expected that the country's steel demand will grow in the future but at a slow pace. By 2035, the apparent consumption of steel is expected to reach about 25 million tons. By then, Thailand's annual per capita steel consumption is expected to reach about 350 kilograms. In the long term, against the background of global steel price readjustments, improvements in production technology and processes to reduce carbon emissions will lead to an increase in production costs. Therefore, all companies in the Thai steel industry chain will inevitably increase the production costs of steel raw materials and steel products. Although the initial price adjustment is not very urgent and is limited to specific groups, companies still need to gradually improve their production processes to reduce direct and indirect carbon emissions in order to maintain long-term competitiveness in the market.

Thailand has always been a net importer of steel, with Japan importing the most steel and China importing the most, followed by Japan and South Korea. Thailand's steel imports will be more than 10 million tons in both years from 2023 to 2024. Thailand's steel imports will reach US$10.975 billion in 2024, a year-on-year decrease of 5.5%. In 2024, Thailand's steel imports will reach 11.3454 million tons, a year-on-year decrease of 6.66%.

Thailand's steel imports are far greater than its exports. According to statistics from the Thai Iron and Steel Association, in the first seven months of 2025, Thailand's steel production was 4.36 million tons, exports were 970,000 tons, and imports were as high as 7.04 million tons, almost meeting two-thirds of domestic demand, of which Chinese steel accounted for nearly half of the total imports. In the first half of 2025, Thailand's total wire rod steel imports were 781,000 tons, of which 535,000 tons of wire rod steel imported from China, a year-on-year increase of 57%. Wire rod steel is a key raw material for the construction and automotive industries.

Import data shows that Thailand's steel imports reached US$1.11 billion in October 2025, a year-on-year increase of 17.5%; the cumulative import volume from January to October was US$11.041 billion, a year-on-year increase of 8.2%. In addition, a large number of investment projects import prefabricated structural steel from abroad, causing an annual loss of more than 16.7 billion baht in economic added value. The capacity utilization rate of Thailand's steel industry is currently only 30%, more than 70% of the market is occupied by imported products, and the industry is on the verge of bankruptcy.

7. Dilemma of Thailand’s steel industry

International competition and local challenges:

Against the backdrop of the continued evolution of the global trade pattern and the adjustment of domestic economic structures, Southeast Asian economies, especially Thailand's steel industry, are experiencing profound changes and challenges. As an important economy in Southeast Asia, Thailand's steel industry has recently faced dual pressures from intensifying competition in the international market and shrinking local market demand. Its industrial dynamics and policy games deserve close attention from cross-border companies and policy researchers.

(1) Industry status quo: intensified international competition and shrinking local demand

Although Thailand's steel industry has imported a total of 4.058 billion baht since the first half of 2024, a slight increase of 3.5% from the same period last year, local steel companies are facing the dilemma of continued decline in capacity utilization. Among them, the total volume of imported steel fell by 6% year-on-year, showing the intensity of competition in the international market. However, it is worth noting that steel imports from China have increased against the trend, reaching 2.397 billion baht, accounting for nearly 60% of Thailand's total imports, reflecting the competitiveness of Chinese steel in the international market and the demand of local Thai companies for low-priced and high-quality steel.

(2) Policy response and industrial resistance

Faced with the impact of low-priced imported steel, the Steel Industry Group of the Thai Institute of Industry has jointly expressed concerns to the government and called for active and effective measures to be taken. The organization recommended that the government conduct an anti-dumping investigation on imported steel to prevent it from further impacting Thai domestic steel companies. This move not only reflects the helplessness and struggle of Thailand's steel industry in the face of international competition, but also highlights the serious damage to the interests of local enterprises caused by the low-price competition of imported steel.

(3) Industrial transformation and sustainable development

Under the double squeeze of international market competition and shrinking local demand, it is particularly important for Thai steel companies to seek breakthroughs and transformation solutions. In addition to government-level policy support, companies themselves also need to adjust and optimize production capacity to improve production efficiency, reduce production costs, and improve product quality. At the same time, the government and enterprises need to strengthen cooperation to jointly promote the transformation, upgrading and sustainable development of the steel industry to cope with increasingly fierce market competition.

(4) Enlightenment to cross-border enterprises and policy researchers

The dilemma and struggle of Thailand's steel industry not only affects the fate of local Thai companies, but also has important implications for cross-border companies and policy researchers who pay attention to the Southeast Asian market. On the one hand, cross-border enterprises need to pay close attention to policy dynamics and market changes in Thailand's steel industry in order to adjust trade strategies in a timely manner; on the other hand, policy researchers should conduct an in-depth analysis of the deep-seated problems and contradictions in Thailand's steel industry to provide scientific basis for government decision-making.

To sum up, Thailand’s steel industry is experiencing a dual test of international competition and local challenges. The government and enterprises need to work together to cope with challenges and seek breakthroughs and transformation solutions to achieve sustainable development of the industry.

8. Outlook of Thailand’s steel industry

A: Industrial policy adjustment

The Thai government has made major adjustments to its industrial policy. According to Aigner, the Minister of Industry of Thailand, at a press conference, the cabinet has initially approved the draft announcement submitted by the Ministry of Industry. The Thai government has adjusted its industrial policy and will completely prohibit the construction and expansion of steel bars for concrete and small steel bar production facilities starting from 2025.

The control measures contained in the draft will be officially implemented on January 10, 2025, and within the next five years, that is, until January 9, 2030, a comprehensive ban will be imposed on the new construction and expansion of concrete steel bars and small steel bar production facilities throughout Thailand. This policy adjustment demonstrates the Thai government’s firm determination to promote the upgrading of the steel industry. Officials noted that the ban was based on an in-depth assessment of current steel product quality issues. The new regulations are adjusted based on the quality issues of steel products and take the opportunity to promote industrial upgrading. Enterprises that meet national standards will gain greater development opportunities. Through capacity control measures, it aims to promote domestic steel companies to improve product quality standards and realize the transformation from traditional extensive production to high value-added and high-quality manufacturing models.

The latest quality inspection report released by Thailand’s Ministry of Industry reveals serious quality problems in the steel industry. In a random inspection of 11 steelmaking companies across the country that use induction furnace technology, 7 companies' products did not meet the standard for boron content and failed to pass the national standard test. This result not only exposed the deficiencies in industry quality supervision, but also seriously affected the market's confidence in local steel products.

B: Policy impact and future prospects

Production capacity and quality control

This policy adjustment is a continuation and strengthening of the original ban. Restrictions originally scheduled to expire on January 9, 2025, will be extended for five years, until January 9, 2030. The government controls the production capacity of steel bars for concrete to relieve excess pressure and promote high-quality production. The new regulations aim to alleviate the pressure of overcapacity in the industry and create conditions for improving product quality by controlling the production capacity of steel bars for concrete. This reflects the Thai government's thoughtfulness in balancing industrial development and quality control.

The recent quality inspection results of Thailand’s Ministry of Industry show that induction furnace steel bar products have quality hazards, which has become an important driving factor for this policy adjustment. The new regulations will strengthen the technical standards of this type of production process and ensure that its products fully comply with national construction safety and engineering quality specifications. Industry Minister Aigner emphasized at the policy briefing that the steel industry is facing the dual challenges of overcapacity and the proliferation of inferior products. The low-price dumping behavior of some foreign-funded enterprises has seriously disrupted the market order. To this end, the Ministry of Industry urgently formulated and promoted the introduction of a draft ban, which was approved in principle by the Cabinet.

Impact on the economy and employment

The new regulations will start from both the quantity and quality levels, orderly control the total steel production capacity, and restrict unnecessary steel imports. The new regulations will help resolve structural contradictions in the steel industry, support Thailand's economic stability and create job opportunities. Thailand’s Ministry of Industry believes that the implementation of the ban will help improve the structural contradictions of the steel industry, promote the long-term healthy development of the industry, and provide positive support for the stability of the Thai economy and the job market.

C: Recommendations for revitalizing Thailand’s steel industry

Thailand's steel industry has been impacted by the entry of Chinese steel companies into the ASEAN market in the past decade, resulting in the continuous reduction of the production scale of local companies. In 2024, Thailand's steel production capacity utilization rate will be only 29%, reflecting the severe situation of the industry.

Chairman of the Steel Group of the Confederation of Thai Industries, Bandu Chuyijeron, proposed seven industry revitalization suggestions to Bangkok Business News.

Industry revitalization measures:

China's steel production is huge and its prices are affordable, thanks to its capacity utilization rate of more than 90%. On the contrary, Thailand's capacity utilization rate is only 30%, which dropped to 29% last year, which makes our production costs remain high. Additionally, China reached capacity saturation by achieving full domestic employment, allowing it to sell steel at a variety of prices to cover costs. Whenever China has overcapacity, it exports large amounts of steel, further exacerbating the plight of Thailand's steel industry.

In response to this problem, the Steel Group of the Federation of Thai Industries joined hands with 10 steel associations to jointly put forward 7 suggestions to Ekana Pengphan, aiming to improve the current situation of Thailand's steel industry. "

(1) It is prohibited to build or expand specific types of steel plants, such as rebar or small rebar production plants for concrete, and hot-rolled steel plate plants when domestic demand in Thailand is already excessive.

(2) Promote government projects to give priority to purchasing steel produced by local companies that have obtained "green industry certification" to encourage investment in upgrading environmentally friendly technologies.

(3) Accelerate the formulation of industrial product standards for prefabricated structural steel to standardize the market and improve product quality.

(4) Restrict the export of scrap steel to ensure a stable supply of local raw materials.

(5) Establish a car dismantling and recycling system, improve the utilization rate of recycled materials such as metal, and realize resource recycling.

(6) Promote "Made in Thailand" certified steel and require public-private partnership projects and government-supported construction projects to compulsorily use local steel certified by the Federation of Thai Industries.

(7) Timely upgrade anti-dumping and anti-circumvention measures based on the actual situation, and introduce countervailing duties and import safeguard measures.