The USA methacrylate butadiene styrene industry is poised for steady expansion over the next decade, driven by technological advancements, rising demand for impact-resistant plastics, and sustained growth across packaging, construction, automotive, and consumer goods sectors.

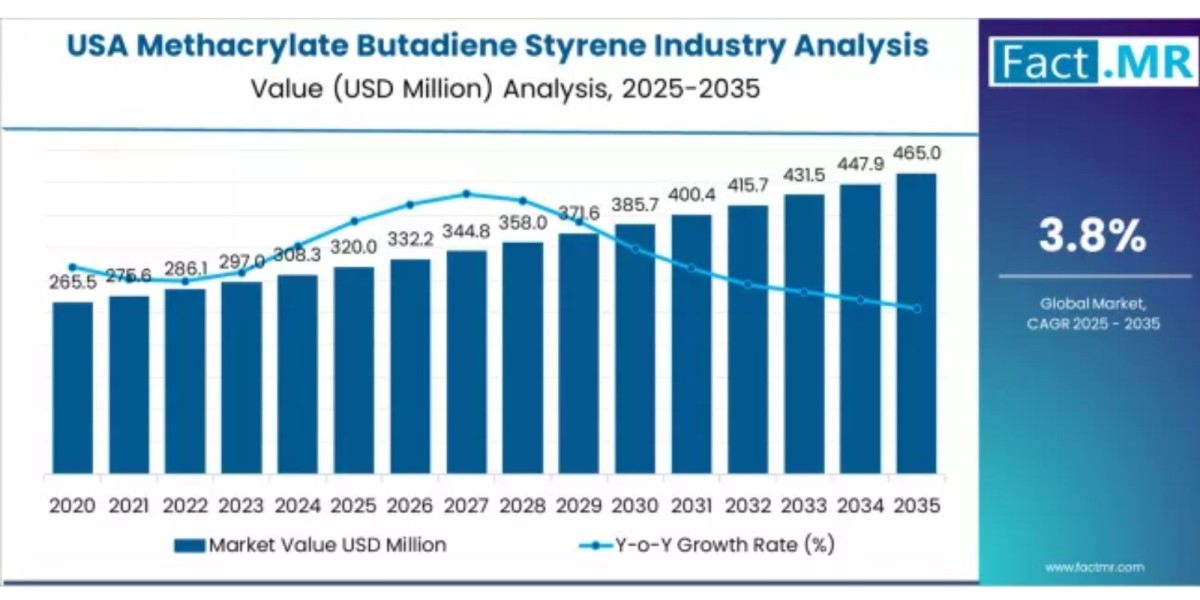

According to a recent industry analysis demand for MBS in the United States is projected to grow from USD 320.0 million in 2025 to USD 465.0 million by 2035, reflecting an absolute rise of USD 145.0 million. This equates to total growth of 45.3%, with a forecast CAGR of 3.8% over the 2025–2035 period.

Methacrylate butadiene styrene known for its excellent impact strength, optical clarity, and weatherability—is becoming increasingly vital for high-performance polymer applications across industries seeking durable and aesthetically superior materials.

Key Market Drivers

Rising Demand for High-Impact, High-Clarity Polymers

Manufacturers in the packaging, building materials, and consumer goods sectors are accelerating adoption of MBS to meet performance and regulatory standards. Its unique combination of toughness, transparency, and processability makes it a preferred modifier for PVC and engineering plastics.

Growth in the Packaging and Construction Industries

The surge in rigid packaging for food, personal care, and pharmaceuticals—coupled with increasing PVC use in pipes, profiles, and sheets—is boosting MBS consumption. MBS enhances impact strength and surface quality, enabling manufacturers to deliver durable and premium-grade products.

Technological Advancements in Polymer Modification

Continuous innovation in polymer processing and resin modification supports the integration of MBS in high-performance applications. Improvements in compounding technology and customization flexibility are expanding its relevance in automotive interiors, displays, and specialty industrial components.

Shift Toward Lightweight and Durable Materials

As product designers prioritize lightweight alternatives to metal and glass, MBS-modified plastics are gaining traction for offering strength without compromising design flexibility or optical clarity.

Browse Full Report: https://www.factmr.com/report/usa-methacrylate-butadiene-styrene-industry-analysis

Regional Growth Highlights

United States: A Mature but Expanding Market

The U.S. remains a major consumer of polymer impact modifiers, driven by large-scale packaging, construction, and consumer product manufacturing. The increasing adoption of MBS in premium PVC applications continues to support industry growth.

Industrial Manufacturing Hubs Lead Demand

Regions with strong PVC and polymer processing clusters—particularly the Midwest, South, and West Coast—are driving large-volume consumption of MBS for both consumer and industrial applications.

Market Segmentation Insights

By Product Type

- Standard MBS Resins – Dominant due to widespread use in PVC processing.

- High-Impact MBS Grades – Growing adoption in applications requiring enhanced durability.

- High-Transparency MBS – Increasing use in rigid packaging and consumer goods.

By Application

- Packaging (Rigid & Transparent) – Primary demand driver.

- Construction Materials (PVC Profiles, Pipes, Sheets) – Rising usage in impact-resistant products.

- Automotive Components – Growing applications in interior components and custom parts.

- Consumer Goods & Electronics – Adoption in durable, high-clarity products.

Market Challenges

Despite the positive outlook, the industry faces key hurdles:

- Volatility in Raw Material Prices: Price fluctuations in methacrylates and butadiene impact production costs.

- Environmental Concerns: Increasing regulatory scrutiny around plastics requires sustainable innovation.

- Global Competition: Imported MBS grades create competitive pricing pressure.

- Technological Substitutes: Alternate impact modifiers may limit expansion in certain segments.

Competitive Landscape

The U.S. MBS market is moderately consolidated, with companies focusing on resin innovation, polymer performance enhancement, and sustainable production. Key players are also investing in advanced compounding technologies and strengthening domestic distribution networks.

Prominent companies include:

- LG Chem

- INEOS Styrolution

- Kaneka Corporation

- Mitsubishi Chemical Group

- Chi Mei Corporation

- Trinseo

- Techno-UMG

These firms continue to expand their product portfolios and partner with PVC processors to meet evolving industrial demands.

Future Outlook: Toward High-Performance and Sustainable Polymer Solutions

Over the next decade, the U.S. methacrylate butadiene styrene industry will increasingly align with innovation in packaging, construction, and engineered plastics. Demand for lightweight, impact-resistant, and visually appealing materials will continue to elevate the importance of MBS across manufacturing value chains.

Manufacturers who prioritize polymer R&D, sustainable production practices, and high-performance resin development are best positioned to capitalize on the industry's projected growth.