Self Employed Mortgages Ontario: How Mortgage Fusion Makes It Easy

Buying a home as a self employed individual in Ontario can be challenging. Traditional lenders often require a stable, salaried income with consistent documentation, making it difficult for self employed Canadians to qualify. Mortgage Fusion specializes in providing self employed mortgages in Ontario, offering flexible solutions tailored to your income structure and business circumstances. By understanding the unique challenges faced by self employed professionals, Mortgage Fusion ensures that mortgage approval is not just possible but also stress-free.

Whether you own a small business, work as a freelancer, or run a consultancy, we focus on your financial strengths rather than conventional constraints. Our team works closely with you to analyze your income streams, evaluate your creditworthiness, and find mortgage products that fit your goals. From first-time buyers to experienced investors, Mortgage Fusion offers personalized mortgage solutions that give you confidence in your financial future.

Understanding Self Employed Mortgages in Ontario

Self employed mortgages differ from conventional mortgages in the way lenders assess your income. Since self employed individuals may have variable earnings or business-related expenses, lenders often require more detailed documentation, such as tax returns, financial statements, and profit/loss reports. Mortgage Fusion streamlines this process by connecting clients with lenders who understand self employed income patterns.

Our approach focuses on highlighting your financial reliability and the stability of your business, which can significantly improve your chances of approval. We evaluate your overall financial health, including assets, liabilities, and savings, to ensure that your mortgage application is strong and credible. Unlike traditional lenders who may impose strict restrictions, Mortgage Fusion provides flexible terms and conditions that adapt to your lifestyle and business needs.

Key Features of Self Employed Mortgages with Mortgage Fusion

Self employed mortgages through Mortgage Fusion come with a variety of benefits designed to support entrepreneurs and independent professionals.

One key feature is flexible income assessment, which considers multiple income sources rather than relying solely on pay stubs or fixed salaries. This allows freelancers, consultants, and small business owners to demonstrate their earning capacity accurately.

Another feature is customized mortgage solutions. We understand that each self employed professional has unique financial circumstances, so we offer tailored options, including variable-rate, fixed-rate, and hybrid mortgage plans.

Mortgage Fusion also emphasizes fast approval processes. Our expert team works efficiently to process applications quickly, minimizing stress and uncertainty.

Additionally, transparent terms and conditions ensure clients understand their mortgage commitments fully, avoiding surprises and fostering financial confidence.

Characteristics of Mortgage Fusion’s Approach

Mortgage Fusion’s approach to self employed mortgages in Ontario is built on several essential characteristics:

Personalized Service: Each client receives one-on-one guidance from a mortgage specialist who understands the challenges of self employed income.

Comprehensive Evaluation: We look beyond basic income to assess your financial health holistically, including assets, business performance, and credit history.

Flexible Lender Network: Our connections with a variety of lenders give you access to mortgage products that might not be available through traditional banks.

Strategic Planning: We provide advice not only on securing a mortgage but also on optimizing repayment plans and managing finances efficiently.

These characteristics combine to create a supportive environment for self employed individuals, making homeownership attainable even in complex financial situations.

Debt Consolidation Ontario: Simplifying Your Finances

In addition to self employed mortgages, Mortgage Fusion offers debt consolidation services in Ontario. Many self employed professionals carry multiple debts, from credit cards to business loans, which can be difficult to manage. Debt consolidation helps by combining these debts into a single loan with potentially lower interest rates, simplifying monthly repayments.

Mortgage Fusion evaluates your current financial obligations and creates a tailored debt consolidation plan. This approach reduces stress, improves cash flow, and enhances your overall financial stability. With clear repayment schedules and lower monthly payments, clients can regain control over their finances while focusing on personal and business growth.

Key Features of Debt Consolidation with Mortgage Fusion

Debt consolidation through Mortgage Fusion provides multiple advantages:

Lower Interest Rates: Consolidating high-interest debts into one loan can significantly reduce the total interest paid over time.

Simplified Payments: Managing one monthly payment instead of multiple obligations makes finances more organized and easier to track.

Improved Credit Management: Timely payments on consolidated loans help improve your credit score, supporting future financial endeavors.

Personalized Financial Guidance: Mortgage Fusion provides expert advice to help you optimize your repayment strategy and avoid future debt pitfalls.

These features ensure that debt consolidation is not just a temporary solution but a sustainable path to financial freedom for self employed professionals.

Characteristics of Effective Debt Management

Mortgage Fusion’s debt consolidation strategies are defined by key characteristics that ensure successful outcomes:

Holistic Assessment: We examine all financial aspects, including current debts, income, and spending habits, to design effective plans.

Customized Solutions: No two clients are alike; we tailor debt consolidation strategies to individual needs.

Transparency: Clients understand all terms, fees, and repayment schedules, avoiding confusion or hidden costs.

Supportive Guidance: Our team guides clients through the process, offering education and insights for better long-term financial health.

By incorporating these characteristics, Mortgage Fusion ensures debt consolidation delivers meaningful improvements in clients’ financial situations.

How to Get Started with Mortgage Fusion

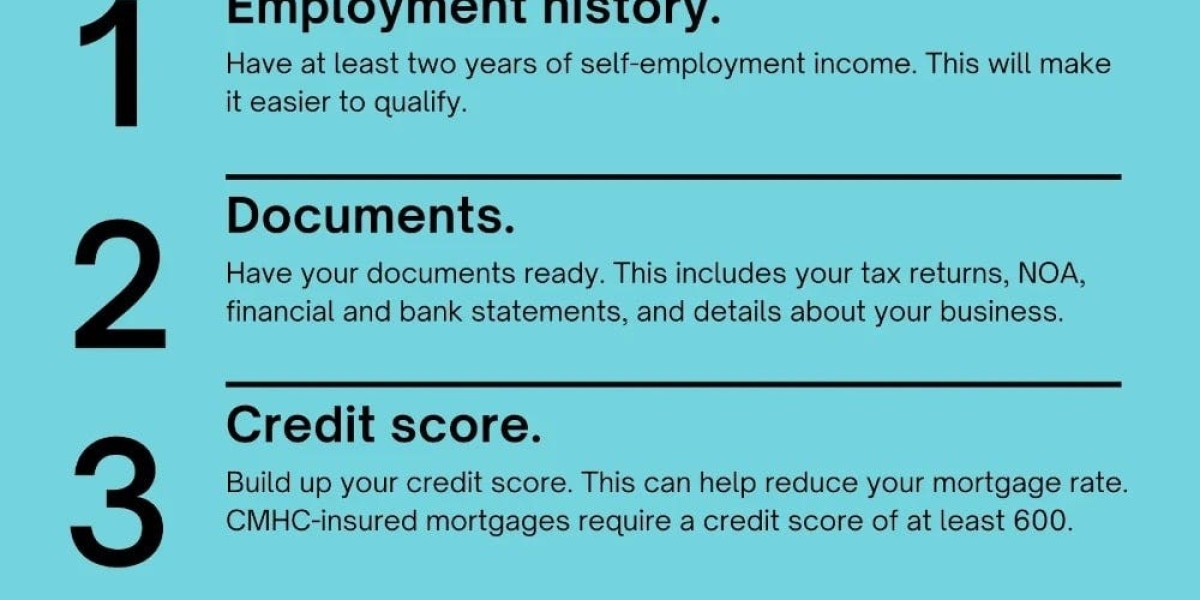

Starting your journey with Mortgage Fusion is simple. For self employed mortgages, begin by gathering essential documents such as tax returns, financial statements, and proof of business income. Schedule a consultation with our mortgage specialists, who will assess your eligibility and discuss options tailored to your needs.

For debt consolidation, provide details of your outstanding debts, income, and expenses. Our team will design a strategy that minimizes monthly payments, reduces interest, and ensures financial stability.

Mortgage Fusion emphasizes clear communication, personalized service, and efficient processes, making both homeownership and debt management achievable for self employed Canadians in Ontario.

Conclusion

Navigating the financial landscape as a self employed individual can be complex, but Mortgage Fusion makes it manageable. Our self employed mortgages in Ontario are designed to accommodate diverse income structures, offering flexible solutions, fast approvals, and transparent terms. Additionally, our debt consolidation Ontario services help clients streamline finances, reduce interest costs, and regain control over their financial health.

With Mortgage Fusion, self employed Canadians can confidently pursue homeownership and debt management without stress or uncertainty. By focusing on personalized strategies, professional guidance, and flexible options, we empower clients to achieve their financial goals and enjoy lasting stability. Take the first step toward a secure financial future today with Mortgage Fusion.