California offers some of the most competitive salaries in the United States, but higher earnings do not always mean higher take-home pay. State taxes, federal deductions, and benefit contributions can significantly affect what professionals actually receive. A paycheck calculator california helps employees and employers forecast real income and make informed financial and career decisions.

Rather than relying on assumptions, professionals use paycheck calculators to gain clarity and plan their future with confidence.

Understanding California’s Pay Reality

Many professionals moving to or working in California focus on gross salary figures. However, California’s tax structure and deductions can reduce net income more than expected. Without accurate forecasting, budgeting and lifestyle planning become difficult.

A paycheck calculator california gives a realistic picture of earnings after deductions, helping individuals understand how much they can truly spend, save, or invest.

How Income Forecasting Supports Smarter Decisions

Knowing your projected take-home pay is essential when evaluating job offers, negotiating raises, or planning major life expenses. Guesswork can lead to financial stress, while accurate forecasting creates stability.

A paycheck calculator california allows professionals to test different scenarios, such as salary changes or benefit selections, before making commitments.

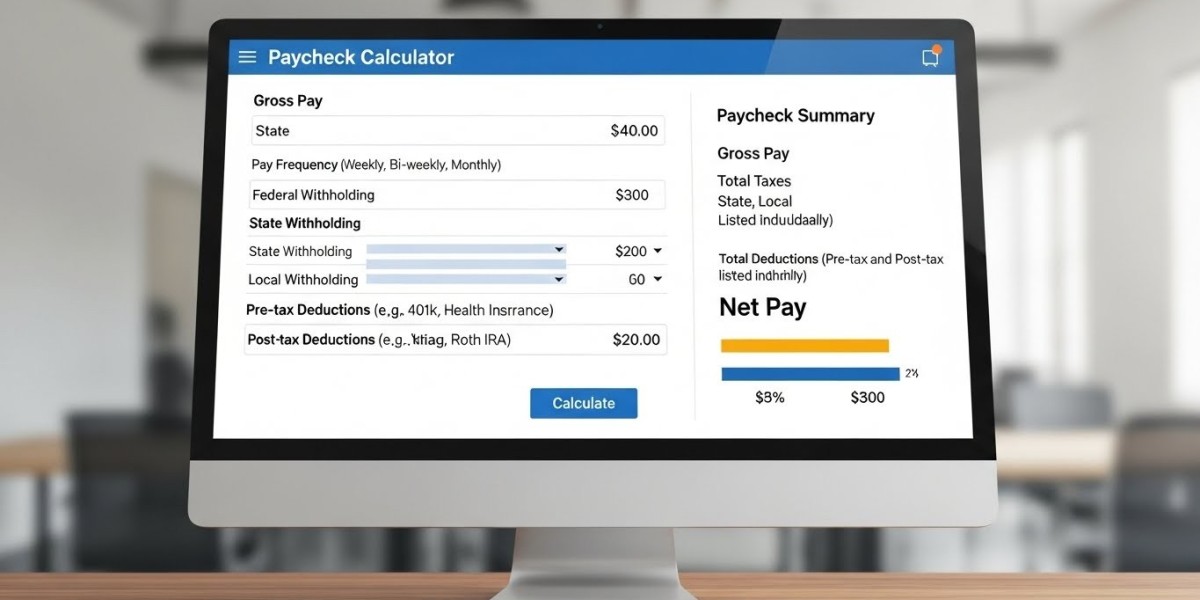

Most paycheck estimates include:

Gross salary or hourly wages

Federal and California state tax deductions

Social Security and Medicare contributions

Benefit and retirement withholdings

Net pay per pay period

This structured breakdown transforms salary discussions into data-driven decisions.

Benefits for Employees and Senior Professionals

Employees rely on a paycheck calculator california to plan monthly expenses, manage savings, and prepare for long-term goals. It also helps compare multiple job offers beyond surface-level salary numbers.

For executives and senior professionals, income clarity becomes even more important. Bonuses, incentive pay, and performance-based compensation can change net income significantly. Accurate calculations reduce uncertainty and strengthen negotiation confidence.

Employer Perspective: Payroll Transparency and Trust

From an employer’s standpoint, payroll accuracy directly affects trust and retention. Using a paycheck calculator california helps organizations communicate compensation clearly and avoid misunderstandings related to deductions or benefits.

Clear payroll expectations improve employee satisfaction, reduce disputes, and support compliance with state and federal regulations—especially in competitive industries.

Strategic Hiring with an Executive Employment Agency

While paycheck calculators explain numbers, hiring strategy requires market insight. An executive employment agency helps organizations design compensation packages that are competitive, realistic, and aligned with industry standards.

An executive employment agency supports businesses by advising on executive salaries, incentive structures, and benefit planning. When combined with paycheck forecasting, this ensures candidates clearly understand their total compensation.

Transparency in Executive Recruitment

Senior-level candidates expect clarity before accepting roles. A paycheck calculator california helps leadership professionals evaluate actual earnings and avoid surprises after onboarding.

When guided by an executive employment agency, compensation discussions become smoother and more transparent. This approach improves offer acceptance rates and strengthens long-term executive retention.

Long-Term Planning for Growth and Stability

Income forecasting is not just about monthly budgeting—it shapes long-term career and business strategies. Employees can plan savings, investments, and lifestyle choices with confidence, while employers can forecast payroll costs and growth opportunities.

Using a paycheck calculator california alongside the expertise of an executive employment agency creates a balanced approach to compensation planning that supports both professional success and organizational growth.

Conclusion

A reliable paycheck calculator california empowers professionals to understand real earnings, plan lifestyles, and make confident career decisions. For employers, it ensures payroll clarity and transparency. When combined with the strategic guidance of an executive employment agency, paycheck insights become a powerful tool for attracting top talent and building long-term success in California’s competitive job market.