In the rapidly evolving world of cryptocurrency, volatility has long been a challenge for investors, traders, and everyday users. Enter stablecoins, a class of digital assets designed to maintain a consistent value by pegging them to a reserve asset like the US dollar. Beyond investment, stablecoins are increasingly becoming the backbone of price-stable crypto payments, enabling businesses and individuals to transact with confidence. In this post, we explore how stablecoins, coupled with advanced tools like s and robust cryptocurrency payment systems, are reshaping the digital financial landscape.

What Are Stablecoins?

Stablecoins are digital currencies designed to minimize the wild swings typical in cryptocurrencies like Bitcoin and Ethereum. Unlike traditional crypto, whose prices can fluctuate dramatically, stablecoins maintain a consistent value by linking to stable assets.

There are three main types:

Fiat-collateralized stablecoins: Backed by traditional currencies like USD (e.g., USDC, Tether).

Crypto-collateralized stablecoins: Backed by other cryptocurrencies in a decentralized manner (e.g., DAI).

Algorithmic stablecoins: Use algorithms and smart contracts to maintain their value without collateral.

By maintaining price stability, stablecoins make it feasible to use crypto for daily transactions, reducing the fear of sudden value drops.

The Rise of Price-Stable Crypto Payments

One of the most compelling use cases for stablecoins is in cryptocurrency payment systems. Businesses can now accept digital currency payments without worrying about volatility.

Benefits include:

Predictable value: Consumers and merchants can transact with confidence, knowing that the amount paid equals the value received.

Faster cross-border payments: Stablecoins can settle in minutes, eliminating the need for banks and international transfer fees.

Lower transaction costs: Many crypto payment systems offer reduced fees compared to traditional financial institutions.

Stablecoins are bridging the gap between the world of decentralized finance (DeFi) and everyday commerce, making crypto not just an investment tool but a functional currency.

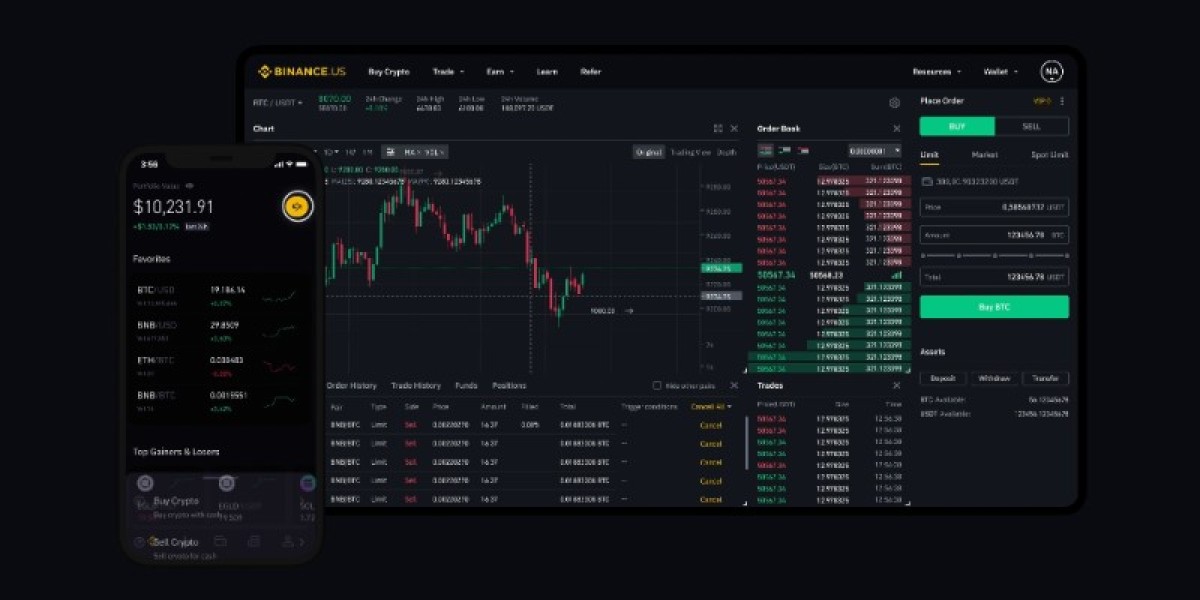

Arbitrage Trading Platforms and Stablecoins

The world of crypto trading thrives on arbitrage, the practice of exploiting price differences across exchanges. Arbitrage trading platforms leverage these differences to generate profits while contributing to market efficiency.

Stablecoins are particularly important in this ecosystem because their consistent value makes arbitrage less risky. Traders can quickly move funds between exchanges, confident that their holdings won’t suddenly lose value due to market volatility.

Key advantages of combining stablecoins with arbitrage include:

Reduced risk of loss during trades

Seamless liquidity management

Opportunities to stabilize crypto markets by balancing prices

By integrating stablecoins into arbitrage platforms, traders can execute complex strategies while mitigating the downside of volatility.

Cryptocurrency Payment Systems Powered by Stablecoins

Modern cryptocurrency payment systems are increasingly incorporating stablecoins to improve usability and adoption. Platforms like Shopify, BitPay, and Circle have integrated stablecoin payments, allowing businesses to accept crypto without exposing themselves to extreme price swings.

Features that make stablecoin payments attractive:

Instant conversion: Merchants can automatically convert stablecoins to fiat currencies, ensuring stable revenue.

Cross-border efficiency: Stablecoins reduce friction in international trade.

Programmable payments: Smart contracts allow automated recurring payments, refunds, and more.

The combination of a stable medium of exchange with programmable features is accelerating the adoption of cryptocurrency in mainstream commerce.

Challenges and Considerations

While stablecoins offer stability, they’re not without challenges:

Regulatory scrutiny: Authorities worldwide are exploring how to regulate stablecoins to prevent misuse.

Centralization risks: Fiat-backed stablecoins rely on reserve assets held by centralized entities.

Technological risks: Smart contract vulnerabilities and platform outages can impact usability.

Despite these challenges, the trajectory for stablecoins in payments remains highly promising. The industry is evolving with improved security, better compliance frameworks, and innovative platforms that reduce risk.

The Future of Stablecoins in Crypto Payments

As digital finance matures, stablecoins are likely to become a cornerstone of price-stable crypto payments. We can anticipate:

Wider adoption across e-commerce and retail: More businesses accepting stablecoins as standard payment.

Integration with DeFi platforms: Automated lending, borrowing, and yield farming using stablecoins.

Enhanced arbitrage trading opportunities: Platforms will continue to optimize for risk-free trading, benefiting from stablecoin liquidity.

Ultimately, stablecoins are not just another cryptocurrency—they are a bridge between traditional finance and the decentralized digital economy.

Conclusion

Stablecoins are revolutionizing how we think about cryptocurrency payments. With their price stability, integration into cryptocurrency payment systems, and utility in arbitrage trading platforms, they are making crypto more usable, reliable, and attractive for everyday transactions.

For businesses and traders alike, embracing stablecoins is no longer optional—it’s a strategic move toward a future where cryptocurrency is both practical and profitable. As adoption continues, the world of digital finance will become faster, more efficient, and significantly more stable.