Section 44AD Presumptive Taxation Explained

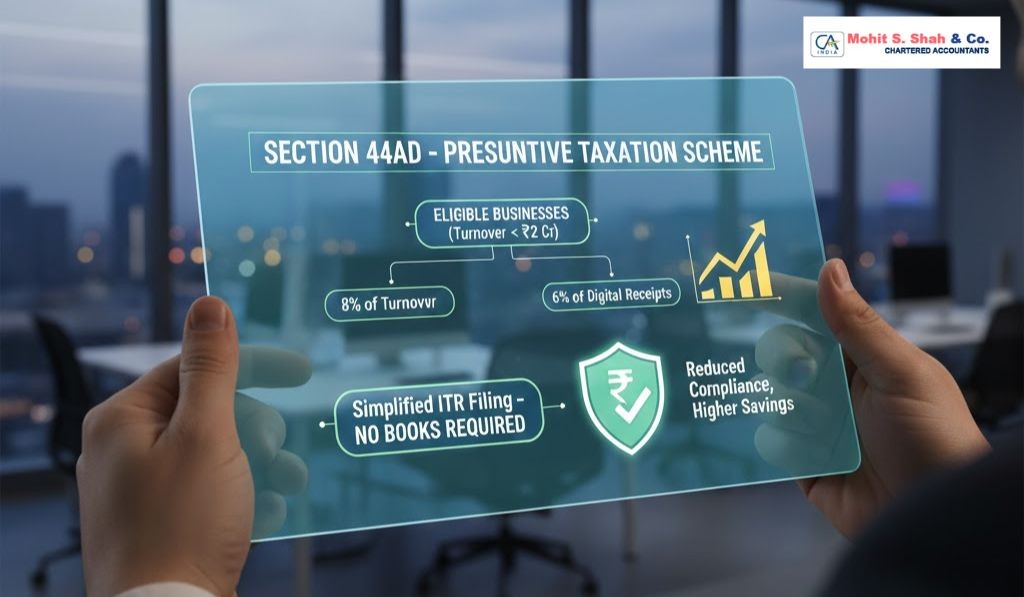

Section 44AD presumptive taxation provides a simplified method for computing income of eligible small businesses in India. It allows taxpayers to declare profits at prescribed rates, reduce compliance burden, and streamline ITR filing under the Income Tax Act, helping small entrepreneurs understand obligations, eligibility conditions, benefits, limitations, and basic compliance requirements in a transparent and predictable tax framework for assessment.

https://www.msshahco.in/blog/s....ection-44ad-presumpt